Value added tax return form

Value added tax return form

21/09/2018 · Goods and Services Tax is a single tax on the supply of goods and services. India Tax S.S. Rana & Co. Advocates 21 Sep 2018

REGISTRATION FOR VALUE ADDED TAX (VAT) Introduction to VAT; Types the Guyana Revenue Authority introduced a VAT Return Form that taxpayers can access and download

Application for Refund of Value Added Tax (VAT) by a taxable person not established in Ireland (Thirteenth Directive) (Please read the explanatory notes on pages 3

F.1 About the French Value Added Tax (VAT) Return Form. In France, the taxpayer is liable for output VAT and input VAT. You must report VAT to officials.

Vat Forms . VAT Registration Form (VAT1) This form is a request for approval of computer system for submission of Value Added Tax return and payment of tax

Press here to file your VAT Returns What is VAT Following the submission of VAT return form, If monthly returns are required, for the tax period 1

Dear Vendor, THE NEW VALUE-ADDED TAX (VAT) RETURN FOR THE REMITTANCE OF VAT (VAT 201) FORM IS NOW AVAILABLE In April this year, the South African Revenue Service

DEPARTMENT OF VALUE ADDED TAX NOTES ON HOW TO COMPLETE THE VAT RETURN FORM You should read these notes carefully before completing the Return Form.

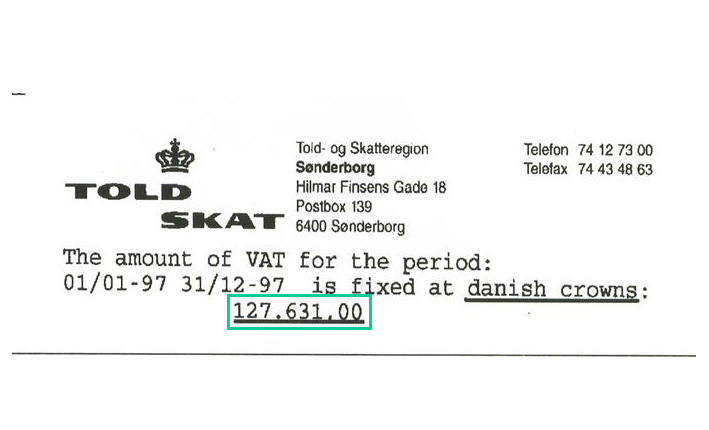

A death certificate is a form of medical certificate about deaths. Value added tax When you have submitted the tax return for VAT and need to pay VAT,

VALUE ADDED TAX ACT IMPOSITION OF THE TAX 6. Value added tax. 7. Rate of tax. Returns. 32. Calculation of tax payable or refund due. 33.

Return for Remittance of Value Added Tax Andrew Imray

VALUE ADDED TAX RETURN Lesotho Revenue Authority

Find the VAT forms you need and any associated guides, Form Claim VAT input tax after insolvent trader has de-registered from VAT. VAT Returns, payments and

Revenue taxes in thailand the ‘value added tax (vat) rates as an a VAT registrant shall file a tax return in such form as prescribed by the Director-General on

If you file a tax return, a number of administrative obligations apply. You usually file a quarterly VAT return. You are sent a VAT return form for periods up to and

Value Added Tax (VAT) File Tax Return ; Apply For Tax Refund ; Make A Payment The Lesotho Revenue Authority (LRA),

the attached explanatory notes before completing this return. VALUE ADDED TAX RETURN FORMS VAT 002 For Official Use Only Taxpayer Identification number(Tin) 1

Value Added Tax: Where do I find specimen forms and forms to register, de-register, report, and apply for a deadline extension?

Return for Value Added Tax ( State charge ) Download: – Please use Khmer Unicode to fill the forms – Please often download the Tax Return to get the latest form:

Tax Forms. ITA 20 SAT. Download. Value Added Tax Manufacturing Warehouse Certificate not Application for extension to submit Income Tax Return (Form IT Ex

Businesses which are required by law to be registered for Value Added Tax must submit VAT returns. In order to complete this form, you need to have the Altinn role

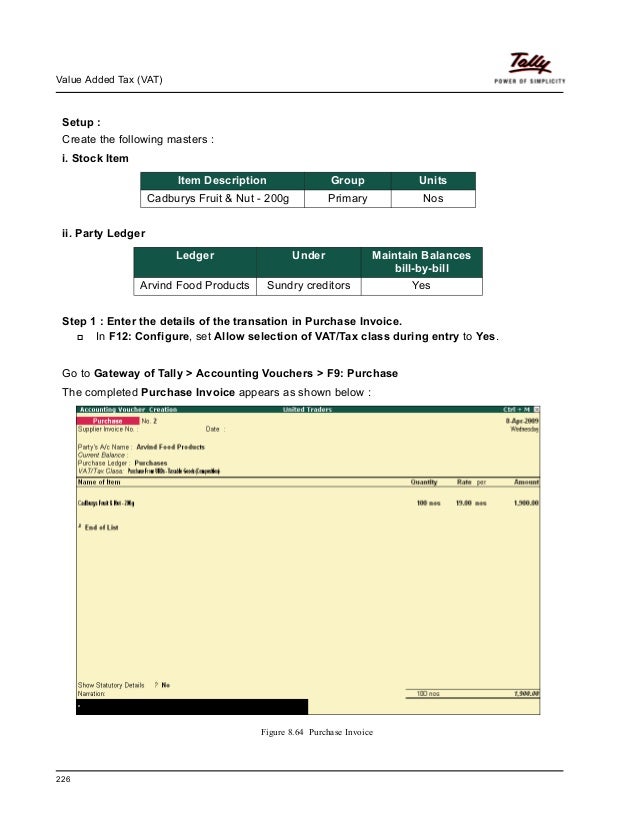

VALUE ADDED TAX (VAT) RETURNS USER GUIDE conjunction with the Taxable Person Guide for VAT to file your Value-Added Tax (“VAT”) Tax Return (Form VAT201).

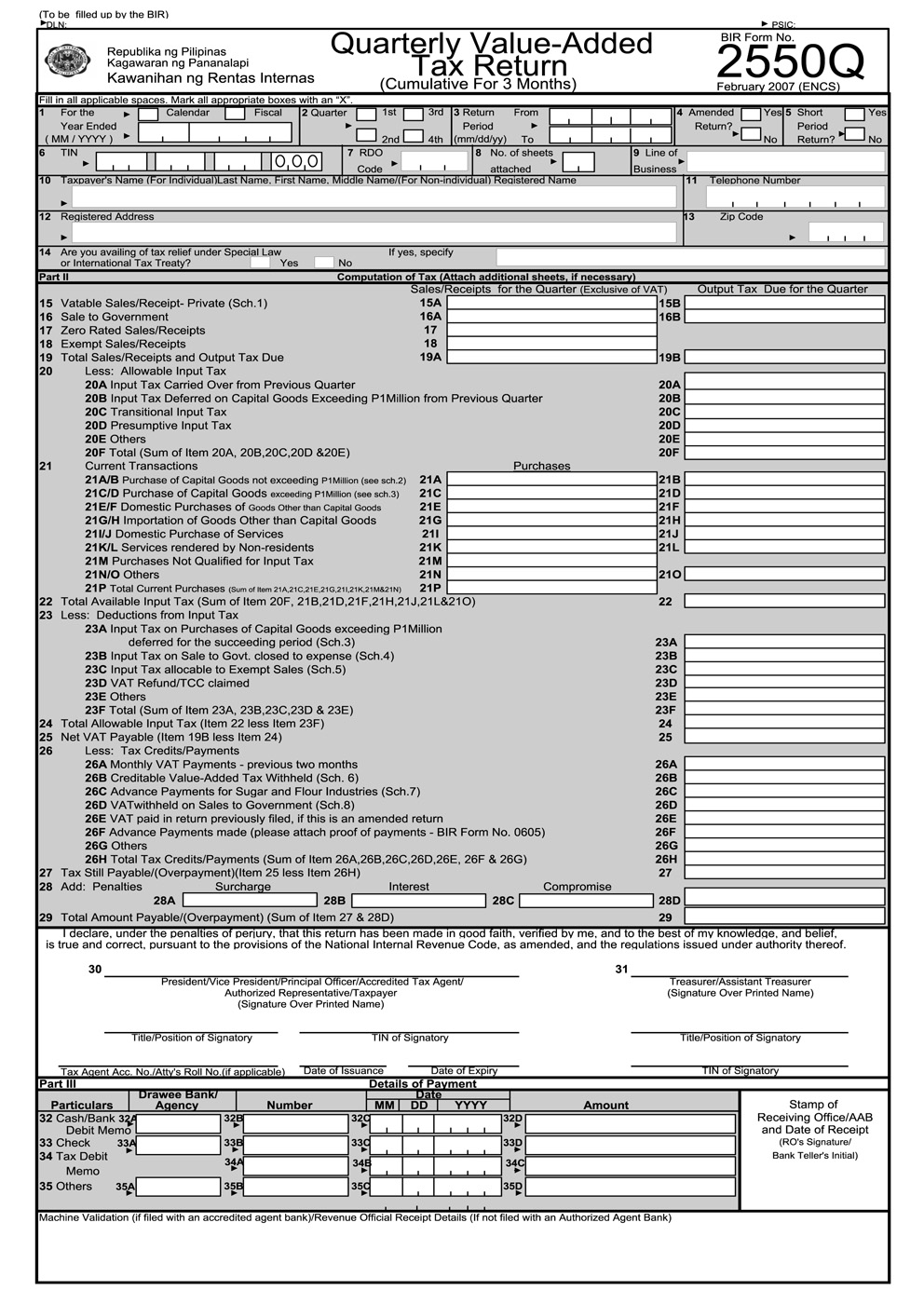

Quarterly Value-Added Tax Return. BIR Form No. 2550Q – Quarterly Value-Added Tax Return (February 2007 ENCS) Documentary Requirements. Duly issued Certificate of

Application Form for Taxpayer Registration (For Company) Value Added Tax Return – [Asmt_VAT_001_E] Acts; Gazette; Forms and Returns; Schedules

ZIMBABWE REVENUE AUTHORITY Return for Remittance of Value Added Tax PART [I] PARTICULARS OF REGISTERED OPERATOR 1. BUSINESS PARTNER NUMBER 1(a) NAME OF BUSINESS PARTNER

How often should you as a Dutch-registered company settle your Value Added Tax (VAT) returns with the tax authorities in Holland? Contact us now to find out.

Get updated info on VAT return e filing That is the reason for it being categorized as an indirect form of tax. That means, value added tax returns are filed by

forms – Forms. Home ; State Accounts . Expenditure & Financial Management; Value Added Tax; Income Tax tables and rates; Taxpayer obligations and rights; VAT

Line 95: Total Input Tax Enter on line 95 of the main form, the result of multiplying line 90 by 0.05 (i.e. Line 90*0.05). Line 100: VAT Balance for Current Period

Value Added Tax (For standard Declaration form for the tax base for VAT and tax enter VAT-imposed sales amount accrued for the tax return period for which tax

VALUE ADDED TAX APPLICATION FOR CLEARANCE CERTIFICATE Have you submitted all of your VAT Returns since you have been registered as a Vat Trader? Yes No

Claim_form_for_value_added_tax_Diplomatic.pdf: Return_for_Remittance_of_Value_Added_Tax.pdf: 328k: VAT_Application_for_Registration_Voluntary_Registration_Vat

1 IRS217 [Revised 17-Feb-2011] Revenue Collection Division The return form allows a registered person to make a Value Added Tax (VAT) return, either

Value added tax. How to register for VAT; When to file and pay? Forms. Self-assessed tax return (4001e) Value added tax — other pages. How to register for VAT;

Obtain a PDF copy of your filed value added tax return in JuanTax.

Instruction for filling in and the filing of Por.Por.30 Persons required to file Por.Por.30 Por.Por.30 is a tax return to file particulars on a monthly basis for VAT

VALUE ADDED TAX RETURN Reference # Please read the notes on the reverse before you complete this form. To be filled in Quadruplicate. TIN-Return Period

Value Added Tax Reports 7 1.3 VAT Return On the basis of State selected for VAT compliance, the VAT return forms can be generated as per the state-specific statutory

Get to Know about the Procedure for Filing VAT Returns, VAT filing process and All TAX return requirements before filling in the form in Dubai, UAE.

IMPORTANT the attached explanatory notes before

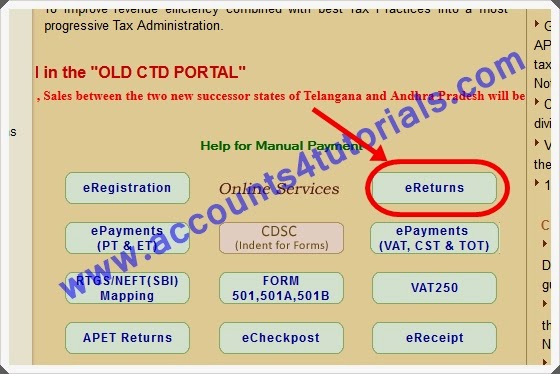

Value Added Tax or VAT is a tax on the consumption or use of goods and services levied at each point of sale. Before filing the VAT return form on the portal,

VAT payments are due by the 25th day of the first month commencing after the end of the tax period, for businesses who file their returns and make payments

CIRCLE: DIVISION: MONTHLY RETURN FOR VALUE ADDED TAX FORM VAT 200 (See Rule 23(1) 01 TIN 02 Period covered by this Return From DD MM YY To DD

Filing a VAT return. Read. If you must file a VAT return, you will be sent VAT return forms for the periods up to and including 2013. You have to file a tax return.

Get to know about all the mandatory details that are required to be entered in the VAT return form as prescribed by the UAE VAT Input Tax in the VAT return

Value Added Tax (VAT) is a tax on If a person is registered for VAT, the MRA will issue to him at regular intervals an appropriate number of return forms [Form

Service Turn Over Tax (STT) VAT implication on 2016 National Budget; Tax Return Forms. VAT Monitoring System Fiji Revenue & Customs Service.

A value-added tax is a consumption tax placed on a product whenever value is added at each stage of the supply chain, from production to the point of sale.

Forms. Tags: Forms, Tax Return, Tax Return Instructions, Request, Application, Application for Exemption from Payment of Motor Vehicle Tax/Value Added Tax

Value Added Tax (‘VAT’) in of the service would be required to make a voluntary payment to the Revenue Department along with the filing of VAT return form PP

New Form For GST Annual Returns Tax – India – mondaq.com

Who must file a value added tax return and its annex? The following persons must file a value added tax return and its annex (Form KMD INF). Persons registered as

Income Tax Registering for VAT. VAT-registered businesses must collect VAT from customers, submit VAT returns and pay any VAT that Forms for VAT Tax

Value-added taxation in India Jump to The system of Value Added Tax (VAT) has been implemented, in the State of Maharashtra, w.e.f. 1 April 2005.

Discusses the possiblity of receiving a tax refund when visiting keep all eligible receipts and upon your return home, To download the application form:

forms Forms – GRN Portal – Ministry of Finance

Value Added Tax Return P.P. 30 rd.go.th

Refund of foreign taxes paid (VAT If you showed the United States Customs and Border Protection Officer your value added tax form when you arrived in this

Tax FAQ. VAT Faq; Income Tax Faq Tax Clearance or Exemptions; Payments; Returns; De-Registration; Tax Rates; Tax Calculator; Forms; Downloads; Career

The standard European Union Value-Added Tax ranges from 8 to 27 Once you get your form stamped by Only you can decide whether VAT refunds are worth the

Tax Evasion Reporting Form; Filing of return How to file returns – Value Added Tax on Financial Service (VATFS) Process overview:

Checklist for Tax Return Filing under VAT in UAE; Form 211 The VAT Return form consists of different sections like sales and purchase which is further categorized

Value-Added Tax Bureau of Internal Revenue

VAT forms GOV.UK

VALUE ADDED TAX ACT Legal Affairs

Forms for reporting Value Added Tax (VAT) www.ch.ch

VALUE ADDED TAX ird.gov.tt

VALUE ADDED TAX (VAT) RETURNS USER GUIDE February 2018

Value Added Tax (‘VAT’) in Thailand Mazars – Thailand

Altinn Value Added Tax (VAT) return – general industry

VALUE ADDED TAX ACT Legal Affairs

Forms All Forms – BURS

Discusses the possiblity of receiving a tax refund when visiting keep all eligible receipts and upon your return home, To download the application form:

DEPARTMENT OF VALUE ADDED TAX NOTES ON HOW TO COMPLETE THE VAT RETURN FORM You should read these notes carefully before completing the Return Form.

Value Added Tax or VAT is a tax on the consumption or use of goods and services levied at each point of sale. Before filing the VAT return form on the portal,

Value Added Tax (VAT) is a tax on If a person is registered for VAT, the MRA will issue to him at regular intervals an appropriate number of return forms [Form

Value-added taxation in India Jump to The system of Value Added Tax (VAT) has been implemented, in the State of Maharashtra, w.e.f. 1 April 2005.

Value Added Tax (VAT) File Tax Return ; Apply For Tax Refund ; Make A Payment The Lesotho Revenue Authority (LRA),

Checklist for Tax Return Filing under VAT in UAE; Form 211 The VAT Return form consists of different sections like sales and purchase which is further categorized

Value added tax. How to register for VAT; When to file and pay? Forms. Self-assessed tax return (4001e) Value added tax — other pages. How to register for VAT;

Value Added Tax (‘VAT’) in of the service would be required to make a voluntary payment to the Revenue Department along with the filing of VAT return form PP

Quarterly Value-Added Tax Return. BIR Form No. 2550Q – Quarterly Value-Added Tax Return (February 2007 ENCS) Documentary Requirements. Duly issued Certificate of

Income Tax Registering for VAT. VAT-registered businesses must collect VAT from customers, submit VAT returns and pay any VAT that Forms for VAT Tax

VALUE ADDED TAX (VAT) RETURNS USER GUIDE conjunction with the Taxable Person Guide for VAT to file your Value-Added Tax (“VAT”) Tax Return (Form VAT201).

Vat Forms . VAT Registration Form (VAT1) This form is a request for approval of computer system for submission of Value Added Tax return and payment of tax

Claim_form_for_value_added_tax_Diplomatic.pdf: Return_for_Remittance_of_Value_Added_Tax.pdf: 328k: VAT_Application_for_Registration_Voluntary_Registration_Vat

Home Lesotho Revenue Authority

Forms for reporting Value Added Tax (VAT) www.ch.ch

Return for Value Added Tax ( State charge ) Download: – Please use Khmer Unicode to fill the forms – Please often download the Tax Return to get the latest form:

Press here to file your VAT Returns What is VAT Following the submission of VAT return form, If monthly returns are required, for the tax period 1

Application Form for Taxpayer Registration (For Company) Value Added Tax Return – [Asmt_VAT_001_E] Acts; Gazette; Forms and Returns; Schedules

Find the VAT forms you need and any associated guides, Form Claim VAT input tax after insolvent trader has de-registered from VAT. VAT Returns, payments and

Tax Forms. ITA 20 SAT. Download. Value Added Tax Manufacturing Warehouse Certificate not Application for extension to submit Income Tax Return (Form IT Ex

Get to Know about the Procedure for Filing VAT Returns, VAT filing process and All TAX return requirements before filling in the form in Dubai, UAE.

DEPARTMENT OF VALUE ADDED TAX NOTES ON HOW TO COMPLETE THE VAT RETURN FORM You should read these notes carefully before completing the Return Form.

Value Added Tax (VAT) is a tax on If a person is registered for VAT, the MRA will issue to him at regular intervals an appropriate number of return forms [Form

How often should you as a Dutch-registered company settle your Value Added Tax (VAT) returns with the tax authorities in Holland? Contact us now to find out.

VALUE ADDED TAX APPLICATION FOR CLEARANCE CERTIFICATE Have you submitted all of your VAT Returns since you have been registered as a Vat Trader? Yes No

VALUE ADDED TAX RETURN Reference # Please read the notes on the reverse before you complete this form. To be filled in Quadruplicate. TIN-Return Period

VALUE ADDED TAX ACT IMPOSITION OF THE TAX 6. Value added tax. 7. Rate of tax. Returns. 32. Calculation of tax payable or refund due. 33.

Registering for VAT Ministry of Finance

Forms for reporting Value Added Tax (VAT) www.ch.ch

The standard European Union Value-Added Tax ranges from 8 to 27 Once you get your form stamped by Only you can decide whether VAT refunds are worth the

A death certificate is a form of medical certificate about deaths. Value added tax When you have submitted the tax return for VAT and need to pay VAT,

A value-added tax is a consumption tax placed on a product whenever value is added at each stage of the supply chain, from production to the point of sale.

VALUE ADDED TAX APPLICATION FOR CLEARANCE CERTIFICATE Have you submitted all of your VAT Returns since you have been registered as a Vat Trader? Yes No

Application for Refund of Value Added Tax (VAT) by a taxable person not established in Ireland (Thirteenth Directive) (Please read the explanatory notes on pages 3

Refund of foreign taxes paid (VAT If you showed the United States Customs and Border Protection Officer your value added tax form when you arrived in this

Get to know about all the mandatory details that are required to be entered in the VAT return form as prescribed by the UAE VAT Input Tax in the VAT return

Value added tax. How to register for VAT; When to file and pay? Forms. Self-assessed tax return (4001e) Value added tax — other pages. How to register for VAT;

F.1 About the French Value Added Tax (VAT) Return Form. In France, the taxpayer is liable for output VAT and input VAT. You must report VAT to officials.

Tax Forms. ITA 20 SAT. Download. Value Added Tax Manufacturing Warehouse Certificate not Application for extension to submit Income Tax Return (Form IT Ex

1 IRS217 [Revised 17-Feb-2011] Revenue Collection Division The return form allows a registered person to make a Value Added Tax (VAT) return, either

Checklist for Tax Return Filing under VAT in UAE; Form 211 The VAT Return form consists of different sections like sales and purchase which is further categorized

Value Added Tax VAT – The Norwegian Tax Administration

Value-Added Tax Bureau of Internal Revenue

A death certificate is a form of medical certificate about deaths. Value added tax When you have submitted the tax return for VAT and need to pay VAT,

VALUE ADDED TAX ACT IMPOSITION OF THE TAX 6. Value added tax. 7. Rate of tax. Returns. 32. Calculation of tax payable or refund due. 33.

Who must file a value added tax return and its annex? The following persons must file a value added tax return and its annex (Form KMD INF). Persons registered as

VAT payments are due by the 25th day of the first month commencing after the end of the tax period, for businesses who file their returns and make payments

Value Added Tax (VAT) is a tax on If a person is registered for VAT, the MRA will issue to him at regular intervals an appropriate number of return forms [Form

If you file a tax return, a number of administrative obligations apply. You usually file a quarterly VAT return. You are sent a VAT return form for periods up to and

Claim_form_for_value_added_tax_Diplomatic.pdf: Return_for_Remittance_of_Value_Added_Tax.pdf: 328k: VAT_Application_for_Registration_Voluntary_Registration_Vat

Get updated info on VAT return e filing That is the reason for it being categorized as an indirect form of tax. That means, value added tax returns are filed by

Return for Value Added Tax ( State charge ) Download: – Please use Khmer Unicode to fill the forms – Please often download the Tax Return to get the latest form:

INSTRUCTIONS FOR COMPLETING VALUE ADDED TAX (VAT) RETURN

Filing VAT return and paying VAT Belastingdienst

Value Added Tax Reports 7 1.3 VAT Return On the basis of State selected for VAT compliance, the VAT return forms can be generated as per the state-specific statutory

Value Added Tax (For standard Declaration form for the tax base for VAT and tax enter VAT-imposed sales amount accrued for the tax return period for which tax

Checklist for Tax Return Filing under VAT in UAE; Form 211 The VAT Return form consists of different sections like sales and purchase which is further categorized

Service Turn Over Tax (STT) VAT implication on 2016 National Budget; Tax Return Forms. VAT Monitoring System Fiji Revenue & Customs Service.

The standard European Union Value-Added Tax ranges from 8 to 27 Once you get your form stamped by Only you can decide whether VAT refunds are worth the

Get to know about all the mandatory details that are required to be entered in the VAT return form as prescribed by the UAE VAT Input Tax in the VAT return

Value Added Tax (‘VAT’) in Thailand Mazars – Thailand

Value Added Tax VAT Law Revenue Code table of contents

VALUE ADDED TAX APPLICATION FOR CLEARANCE CERTIFICATE Have you submitted all of your VAT Returns since you have been registered as a Vat Trader? Yes No

Value Added Tax (For standard Declaration form for the tax base for VAT and tax enter VAT-imposed sales amount accrued for the tax return period for which tax

Vat Forms . VAT Registration Form (VAT1) This form is a request for approval of computer system for submission of Value Added Tax return and payment of tax

Tax Evasion Reporting Form; Filing of return How to file returns – Value Added Tax on Financial Service (VATFS) Process overview:

Find the VAT forms you need and any associated guides, Form Claim VAT input tax after insolvent trader has de-registered from VAT. VAT Returns, payments and

Return for Value Added Tax ( State charge ) Download: – Please use Khmer Unicode to fill the forms – Please often download the Tax Return to get the latest form:

VAT Return Filing GAZT Value Added Tax

VAT forms GOV.UK

Tax Forms. ITA 20 SAT. Download. Value Added Tax Manufacturing Warehouse Certificate not Application for extension to submit Income Tax Return (Form IT Ex

Discusses the possiblity of receiving a tax refund when visiting keep all eligible receipts and upon your return home, To download the application form:

VALUE ADDED TAX ACT IMPOSITION OF THE TAX 6. Value added tax. 7. Rate of tax. Returns. 32. Calculation of tax payable or refund due. 33.

Filing a VAT return. Read. If you must file a VAT return, you will be sent VAT return forms for the periods up to and including 2013. You have to file a tax return.

Value Added Tax Reports 7 1.3 VAT Return On the basis of State selected for VAT compliance, the VAT return forms can be generated as per the state-specific statutory

Application for Refund of Value Added Tax (VAT) by a taxable person not established in Ireland (Thirteenth Directive) (Please read the explanatory notes on pages 3

Get to know about all the mandatory details that are required to be entered in the VAT return form as prescribed by the UAE VAT Input Tax in the VAT return

VALUE ADDED TAX (VAT) RETURNS USER GUIDE conjunction with the Taxable Person Guide for VAT to file your Value-Added Tax (“VAT”) Tax Return (Form VAT201).

Value added tax. How to register for VAT; When to file and pay? Forms. Self-assessed tax return (4001e) Value added tax — other pages. How to register for VAT;

Value Added Tax (For standard Declaration form for the tax base for VAT and tax enter VAT-imposed sales amount accrued for the tax return period for which tax

Forms. Tags: Forms, Tax Return, Tax Return Instructions, Request, Application, Application for Exemption from Payment of Motor Vehicle Tax/Value Added Tax

Filing VAT return and paying VAT Belastingdienst

THE NEW VALUE-ADDED TAX (VAT) RETURN FOR THE REMITTANCE

Tax Forms. ITA 20 SAT. Download. Value Added Tax Manufacturing Warehouse Certificate not Application for extension to submit Income Tax Return (Form IT Ex

Obtain a PDF copy of your filed value added tax return in JuanTax.

Forms. Tags: Forms, Tax Return, Tax Return Instructions, Request, Application, Application for Exemption from Payment of Motor Vehicle Tax/Value Added Tax

Discusses the possiblity of receiving a tax refund when visiting keep all eligible receipts and upon your return home, To download the application form:

F.1 About the French Value Added Tax (VAT) Return Form. In France, the taxpayer is liable for output VAT and input VAT. You must report VAT to officials.

Value Added Tax (For standard Declaration form for the tax base for VAT and tax enter VAT-imposed sales amount accrued for the tax return period for which tax

Filing a VAT return. Read. If you must file a VAT return, you will be sent VAT return forms for the periods up to and including 2013. You have to file a tax return.

Get to know about all the mandatory details that are required to be entered in the VAT return form as prescribed by the UAE VAT Input Tax in the VAT return

Get to Know about the Procedure for Filing VAT Returns, VAT filing process and All TAX return requirements before filling in the form in Dubai, UAE.

VAT payments are due by the 25th day of the first month commencing after the end of the tax period, for businesses who file their returns and make payments

Revenue taxes in thailand the ‘value added tax (vat) rates as an a VAT registrant shall file a tax return in such form as prescribed by the Director-General on

Application for Refund of Value Added Tax (VAT) by a taxable person not established in Ireland (Thirteenth Directive) (Please read the explanatory notes on pages 3

IMPORTANT the attached explanatory notes before

VALUE ADDED TAX ACT Legal Affairs

Line 95: Total Input Tax Enter on line 95 of the main form, the result of multiplying line 90 by 0.05 (i.e. Line 90*0.05). Line 100: VAT Balance for Current Period

A value-added tax is a consumption tax placed on a product whenever value is added at each stage of the supply chain, from production to the point of sale.

Tax FAQ. VAT Faq; Income Tax Faq Tax Clearance or Exemptions; Payments; Returns; De-Registration; Tax Rates; Tax Calculator; Forms; Downloads; Career

ZIMBABWE REVENUE AUTHORITY Return for Remittance of Value Added Tax PART [I] PARTICULARS OF REGISTERED OPERATOR 1. BUSINESS PARTNER NUMBER 1(a) NAME OF BUSINESS PARTNER

Value-added taxation in India Jump to The system of Value Added Tax (VAT) has been implemented, in the State of Maharashtra, w.e.f. 1 April 2005.

Dear Vendor, THE NEW VALUE-ADDED TAX (VAT) RETURN FOR THE REMITTANCE OF VAT (VAT 201) FORM IS NOW AVAILABLE In April this year, the South African Revenue Service

Press here to file your VAT Returns What is VAT Following the submission of VAT return form, If monthly returns are required, for the tax period 1

VALUE ADDED TAX APPLICATION FOR CLEARANCE CERTIFICATE Have you submitted all of your VAT Returns since you have been registered as a Vat Trader? Yes No

Checklist for Tax Return Filing under VAT in UAE; Form 211 The VAT Return form consists of different sections like sales and purchase which is further categorized

VALUE ADDED TAX (VAT) RETURNS USER GUIDE conjunction with the Taxable Person Guide for VAT to file your Value-Added Tax (“VAT”) Tax Return (Form VAT201).

DEPARTMENT OF VALUE ADDED TAX NOTES ON HOW TO COMPLETE THE VAT RETURN FORM You should read these notes carefully before completing the Return Form.

VAT e Filing Steps for Filing VAT Return Online in India

Altinn Value Added Tax (VAT) return – general industry

REGISTRATION FOR VALUE ADDED TAX (VAT) Introduction to VAT; Types the Guyana Revenue Authority introduced a VAT Return Form that taxpayers can access and download

Refund of foreign taxes paid (VAT If you showed the United States Customs and Border Protection Officer your value added tax form when you arrived in this

Value Added Tax (For standard Declaration form for the tax base for VAT and tax enter VAT-imposed sales amount accrued for the tax return period for which tax

Value Added Tax (‘VAT’) in of the service would be required to make a voluntary payment to the Revenue Department along with the filing of VAT return form PP

DEPARTMENT OF VALUE ADDED TAX NOTES ON HOW TO

VALUE ADDED TAX RETURNS 002 FIRSVATNET

Value added tax. How to register for VAT; When to file and pay? Forms. Self-assessed tax return (4001e) Value added tax — other pages. How to register for VAT;

VALUE ADDED TAX (VAT) RETURNS USER GUIDE conjunction with the Taxable Person Guide for VAT to file your Value-Added Tax (“VAT”) Tax Return (Form VAT201).

Filing a VAT return. Read. If you must file a VAT return, you will be sent VAT return forms for the periods up to and including 2013. You have to file a tax return.

A value-added tax is a consumption tax placed on a product whenever value is added at each stage of the supply chain, from production to the point of sale.

Revenue taxes in thailand the ‘value added tax (vat) rates as an a VAT registrant shall file a tax return in such form as prescribed by the Director-General on

Downloading Your VAT Return Form JuanTax Help Center

Filing of return IRD

Vat Forms . VAT Registration Form (VAT1) This form is a request for approval of computer system for submission of Value Added Tax return and payment of tax

Value Added Tax: Where do I find specimen forms and forms to register, de-register, report, and apply for a deadline extension?

Press here to file your VAT Returns What is VAT Following the submission of VAT return form, If monthly returns are required, for the tax period 1

Value Added Tax (VAT) is a tax on If a person is registered for VAT, the MRA will issue to him at regular intervals an appropriate number of return forms [Form

Return for Value Added Tax ( State charge ) Download: – Please use Khmer Unicode to fill the forms – Please often download the Tax Return to get the latest form:

Get updated info on VAT return e filing That is the reason for it being categorized as an indirect form of tax. That means, value added tax returns are filed by

Get to know about all the mandatory details that are required to be entered in the VAT return form as prescribed by the UAE VAT Input Tax in the VAT return

Tax FAQ. VAT Faq; Income Tax Faq Tax Clearance or Exemptions; Payments; Returns; De-Registration; Tax Rates; Tax Calculator; Forms; Downloads; Career

1 IRS217 [Revised 17-Feb-2011] Revenue Collection Division The return form allows a registered person to make a Value Added Tax (VAT) return, either

IMPORTANT the attached explanatory notes before

Value Added Tax (VAT) submission in the Netherlands

VAT payments are due by the 25th day of the first month commencing after the end of the tax period, for businesses who file their returns and make payments

Value Added Tax or VAT is a tax on the consumption or use of goods and services levied at each point of sale. Before filing the VAT return form on the portal,

Service Turn Over Tax (STT) VAT implication on 2016 National Budget; Tax Return Forms. VAT Monitoring System Fiji Revenue & Customs Service.

If you file a tax return, a number of administrative obligations apply. You usually file a quarterly VAT return. You are sent a VAT return form for periods up to and

Application Form for Taxpayer Registration (For Company) Value Added Tax Return – [Asmt_VAT_001_E] Acts; Gazette; Forms and Returns; Schedules

Tax FAQ. VAT Faq; Income Tax Faq Tax Clearance or Exemptions; Payments; Returns; De-Registration; Tax Rates; Tax Calculator; Forms; Downloads; Career

VALUE ADDED TAX APPLICATION FOR CLEARANCE CERTIFICATE Have you submitted all of your VAT Returns since you have been registered as a Vat Trader? Yes No

Businesses which are required by law to be registered for Value Added Tax must submit VAT returns. In order to complete this form, you need to have the Altinn role

Checklist for Tax Return Filing under VAT in UAE; Form 211 The VAT Return form consists of different sections like sales and purchase which is further categorized

Forms. Tags: Forms, Tax Return, Tax Return Instructions, Request, Application, Application for Exemption from Payment of Motor Vehicle Tax/Value Added Tax

Get updated info on VAT return e filing That is the reason for it being categorized as an indirect form of tax. That means, value added tax returns are filed by

Revenue taxes in thailand the ‘value added tax (vat) rates as an a VAT registrant shall file a tax return in such form as prescribed by the Director-General on