Military spouse tax exemption form

Military spouse tax exemption form

The Military Spouses Residency Relief Act amends the The effective date for the income tax exemption is for the tax Servicemember’s Form W-2; Spouse’s

IT MIL-SP Rev. 3/17 . P.O. Box 2476 Columbus, OH 43216-2476 1-800-282-1780 . Exemption from Withholding – Military Spouse Employee . Purpose: The Federal Military

If you believe that you paid tax in error, use Form CT-1040X to though you will be exempt from tax for also subject to tax. Military Spouses

Nonresident Military Spouse Withholding Exemption Legal last name Legal first name M.I. Social Security Number Address (number and street) City or Post Office State

The Best Tax Tips for Military Spouses in 2016. A military spouse is exempt from paying state income taxes when he or she: a.

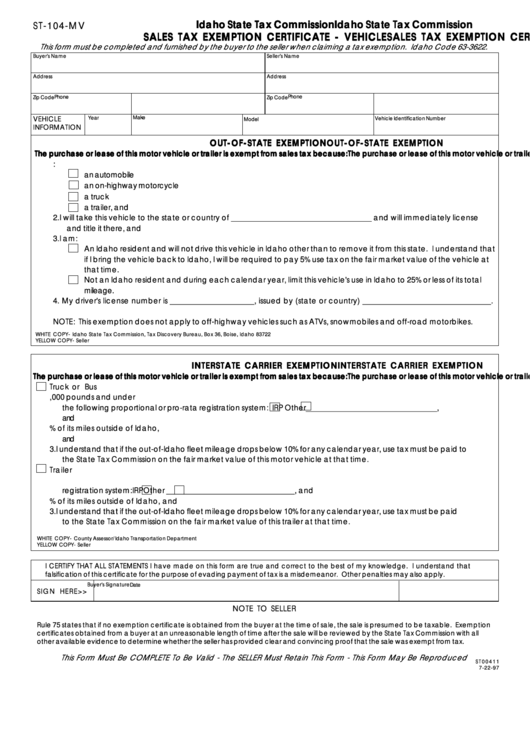

Employer Section This exemption is valid through December 31, 2017. A new Form ID-MS1 is required each year. I claim an exemption from Idaho withholding based on the

Form WH-4MIL is to be used only for employees claiming exemption from Indiana’s income tax withholding requirements because they meet the conditions set forth under

Indiana Department of Revenue Annual Nonresident Military Spouse Earned Income Withholding Tax Exemption Form This form is for the employer’s records.

SERVICE EXEMPTION FROM SPECIFIC OWNERSHIP TAX AFFIDAVIT required to be attached to this form. Servicemember’s spouse’s military ID must list the servicemember

Download or print the 2017 Colorado Form DR 1059 (Military Spouse — Exemption from Withholding) for FREE from the Colorado Department of Revenue.

Idaho State Tax Commission Employee’s Idaho Military Spouse Withholding Exemption Certificate; On Idaho Form 43, select “Military Nonresident” for the

Home Forms.OK.Gov Page 1 Annual Withholding Tax Exemption Certification for Military Spouse. Page 1 Previous: 1 of 2: Next :

INSTRUCTIONS: ARKANSAS ANNUAL WITHHOLDING TAX EXEMPTION CERTIFICATE FOR MILITARY SPOUSE (Form ARW-4MS) Military spouses claiming an exemption from Arkansas

Military Spouses Residency Relief Act New Jersey

https://youtube.com/watch?v=sklX09ujQbU

Tax Information

Wisconsin Department of Revenue: Nonresident Military Spouse Withholding Exemption Common Questions

Exemption from Withholding – Military Spouse Employee Ohio Employers: In November 2009, Congress passed the Federal Military Spouses Residency Relief Act, Public Law

Active Military . If Carolina tax on that income. Military Spouse met to qualify for exemption. If you are the spouse of a servicemember who is

The Military Spouses Residency To request a refund of exempt 2009 Louisiana income tax Worksheet and identified as military spouse income. Form W-2

Download or print the 2017 New Mexico Form RPD-41348 (Military Spouse Withholding Tax Exemption Statement) for FREE from the New Mexico Taxation and Revenue Department.

Arkansas tax exemption for military spouses. each non-resident member should fill out the tax exemption certificate and send the form through mail or email

Nonresident Military Service Members and Spouses. A recent federal law provides an exemption from state income tax for any servicemember’s spouse, who is present in a

Withholding and Taxation of Certain Nonresident Military Spouses 1) may be exempt from Georgia income tax files a withholding exemption form in

View, download and print fillable Ar-ms – Tax Exemption Certificate For Military Spouse in PDF format online. Browse 6 Military Tax Exempt Form Templates collected

If your spouse is in the military, you likely move from state to state. Generally speaking, the state that you live and work in during any given tax year is the state

Military Personnel & Their Spouses. The following instructions are for military personnel filing a Utah income tax return: Am I a Utah resident? Is my military income

vehicle license tax and registration fees. The Special Military Exemption is available one time per deployment and may separate exemption form. A spouse,

Civilian Spouse Employed in Maryland: The wages earned by a spouse of a nonresident U.S. servicemember may be exempt from Maryland income tax under the Military

The Military Spouses Residency Relief Act, Property Tax Exemption for Certain Veterans; Military Information (Form 558) Forms for Military Personnel.

What Form Should I File Military Spouse VA. Free Help with your Taxes; Military Tax Tips; What Form Cigarette and Tobacco Taxes. Cigarette Resale Exemption

DEPARTMENT OF TAXATION PERSONAL EXEMPTION WORKSHEET FORM VA-4 EMPLOYEE’S VIRGINIA INCOME TAX WITHHOLDING EXEMPTION as amended by the Military Spouses

Certificate of Exemption from Yes No Are you a military spouse exempt under the • Information and forms are available on the Tax Department’s

My military spouse and I are form with attached copy of the military ID card Colorado are exempt from Colorado income tax because I meet

(Exemption applies to Personal Property Tax Only) The Servicemembers’ Civil Relief Act exempts active duty military personnel from personal property tax in any

State of Louisiana Exemption from Withholding Louisiana Income Tax Form L-4E as amended by the Military Spouses Residency Relief Act

New Mexico Taxation and Revenue Department Military Spouse Withholding Tax Exemption Statement Instructions Page 2 of 3 RPD-41348 Int. 07/2010 Form RPD-41348 must be

Nonresidence and Military Service Exemption from Specific

Download or print the 2017 Colorado (Military Spouse — Exemption from Withholding) (2017) and other income tax forms from the Colorado Department of Revenue.

What is the Military Spouses Frequently Asked Questions Regarding the Military Spouses North Carolina withholding tax? The spouse must complete Form NC

As a military spouse tax time can be stressful. Tax Tips for Military Spouses. Publication 3 may also be ordered by calling 1-800-TAX-FORM

IL-W-5-NR Employee’s Statement of Nonresidence in Illinois • is exempt from Illinois Income Tax on compensation under the Military Spouses Residency Relief Act.

The State of Arkansas Tax Exemption Certificate For Military Spouse or Form AR-MS to claim exemption from Arkansas income tax .

I claim exemption from Maryland local tax because I live as amended by the Military Spouses Employee’s Maryland Withholding Exemption Certificate FORM

Spouse details married or de facto 2017 Australian

New York State Income Tax Exemption for Military Pay. your spouse’s income) may be subject to tax. about NYS tax exemptions for Veterans and access forms,

Military and Spouse – State taxes Active duty service members have always been able to keep one state as their state of legal Military Spouses and State Taxes

Kansas employers should request evidence that the military spouse is Spouses claiming an exemption from Kansas Withholding tax may Kansas Department of Revenue .

Tax Tips for Military Spouses Military.com

DRS Income Tax Information-Military ct.gov

Spouse details – married or de facto 2017. You will usually find this amount on your spouse’s tax return or Make sure you include only your spouse’s exempt

may choose to file a joint return with the resident spouse on Form servicemember’s spouse is exempt from Hawaii income tax Tax Information Release No. 2010-01 .

View, download and print Rpd-41348 – Military Spouse Withholding Tax Exemption Statement pdf template or form online. 10 New Mexico Tax Exempt Form Templates are

Demystifying the MSRRA (Military Spouse While the income tax protections for military spouses are now Wisconsin / Form W-221. States with no income tax

MilSpouse State Tax Guide to Using MSRRA – IFM My Money Blog

How to Fill Out a W-4 Form When Your Spouse Is in the

I am the spouse of a military service member, living in Virginia. Am I exempt from filing Virginia income tax returns under the Military Spouses Residency Relief Act

2/03/2014 · MilSpouse State Tax Guide to Using MSRRA. The Earned Income Withholding Tax Exemption Form, Military Spouse Withholding Tax Exemption

… you do not have to file a Maryland income tax return. Military and military pay. You must also file Form spouses in the military and not

Where to Get California Tax Forms and Publications Tax Returns on page 2 . Military Spouses Residency Relief Act Deployed Military Exemption – Minimum

… exemption under the MSRRA must complete Form M-4-MS, Annual Withholding Tax Exemption Certificate for Tax Exemption Certificate for Military Spouse,

Oregon doesn’t tax your military pay while you are stationed in Oregon. File an Oregon Form OR-40-N if you or your spouse had income from other Oregon sources.

In addition, a military spouse who is completing Form IT-203 and has income which is exempt under the Act is required to enter the special condition code “

… Tax Exemption Certificate for Military Spouse, Form a completed Military Spouse Withholding Tax Exemption to “MilSpouse State Tax Guide to

State Tax Information. Servicemember or surviving spouse (if 60 on the last day of the tax year) 1989, all military retired pay is exempt from taxes.

How does the federal Military Spouses Residency Relief Act Under the new Military Spouses Residency Relief Act, Tax Forms: Powered By Oracle

What Form Should I File Military Spouse VA Virginia Tax

16/05/2018 · Forms and Instructions. Form See Tax Information for Members of the Military. Tax Laws Affecting the Military. These tax laws provide some special

Claiming Exemption from Maryland Withholding for Civilian Military Spouse: Maryland State employees who wish to claim exception for Maryland withholding on the basis

No Return Required-Military Online Form Property Tax Exemption for Certain Veterans If you are the spouse of a military servicemember,

Form M-4-MS Annual Withholding Tax Exemption Certificate for Nonresident Military Spouse Read instructions below before completing this form. After completion, give

Military Spouses Residency Relief A SM does not pay State taxes on military pay and like New Jersey and Pennsylvania, exempt from taxation the

Form OW-9MSE Annual Withholding Tax Exemption Certification for Military Spouse Instructions NOTE: This form must be renewed annually. Notice to Employers

MILITARY SPOUSES RESIDENCY RELIEF ACT . eligible spouses should claim an exemption from servicemember is still subject to Mississippi income tax on non

Illinois Department of Revenue Constance Beard, may subtract tax-exempt military pay on Schedule Act that exempt wages from tax apply only to spouses of service

APPLICATION FOR TAX EXEMPTION or TAX RELIEF FOR MILITARY SERVICEMEMBERS & LEGAL SPOUSES (Exemption applies to Personal Property Tax Only)

19/11/2009 · Military Spouses Residency Relief Act to also apply to a military spouse’s non-military service (Tax Information for Military Personnel

COM/RAD 4 7- Employee information Military spouse information Exemption from Maryland Withholding Tax for a Qualified Civilian Spouse of a U.S. Armed

Military Spouses Residency Relief in ink “Military Spouse” at the top of the Form and attach Act may claim an exemption from New Jersey Income Tax

A Revenue Information Bulletin Military Spouse Income Tax Exemption a military spouse must file a Form L-4E each year if the spouse qualifies for the

Page 1 of 1 Military Spouses Residency Relief Act Claim For Property Tax Exemption In The State of Connecticut Amendment Under The Service Members’ Civil Relief Act

Form OW-9-MSE Annual Withholding Tax Exemption Certification for Military Spouse Instructions NOTE: This form must be completed annually. Notice to Employers

Withholding Tax Exemption Certificate A4-MSFORM Employers are required to obtain from the employee a clear photocopy of their current military spouse ID, Form DD

Revenue Form K–4M 42A804–M (11–10) NONRESIDENT MILITARY SPOUSE Withholding Tax Exemption Certifi cate Commonwealth of Kentucky DEPARTMENT OF REVENUE

Military Personnel who are Nonresidents of Maryland

Illinois Department of Revenue Constance Beard Director

Colorado Form DR 1059 (Military Spouse- Exemption from

Demystifying the MSRRA (Military Spouse Residency Relief

https://youtube.com/watch?v=me5FqZa5tXI

MilSpouse State Tax Guide to Using MSRRA – Attiyya S

DOR Nonresident Military Spouse Withholding Exemption

Individual Income Tax Ohio Department of Taxation

Home Forms.OK.Gov Page 1 Annual Withholding Tax Exemption Certification for Military Spouse. Page 1 Previous: 1 of 2: Next :

View, download and print fillable Ar-ms – Tax Exemption Certificate For Military Spouse in PDF format online. Browse 6 Military Tax Exempt Form Templates collected

19/11/2009 · Military Spouses Residency Relief Act to also apply to a military spouse’s non-military service (Tax Information for Military Personnel

I am the spouse of a military service member, living in Virginia. Am I exempt from filing Virginia income tax returns under the Military Spouses Residency Relief Act

… exemption under the MSRRA must complete Form M-4-MS, Annual Withholding Tax Exemption Certificate for Tax Exemption Certificate for Military Spouse,

A Revenue Information Bulletin Military Spouse Income Tax Exemption a military spouse must file a Form L-4E each year if the spouse qualifies for the

New Mexico Form RPD-41348 (Military Spouse Withholding Tax

Military Personnel who are Nonresidents of Maryland

The Military Spouses Residency To request a refund of exempt 2009 Louisiana income tax Worksheet and identified as military spouse income. Form W-2

View, download and print fillable Ar-ms – Tax Exemption Certificate For Military Spouse in PDF format online. Browse 6 Military Tax Exempt Form Templates collected

Download or print the 2017 New Mexico Form RPD-41348 (Military Spouse Withholding Tax Exemption Statement) for FREE from the New Mexico Taxation and Revenue Department.

IT MIL-SP Rev. 3/17 . P.O. Box 2476 Columbus, OH 43216-2476 1-800-282-1780 . Exemption from Withholding – Military Spouse Employee . Purpose: The Federal Military

Form OW-9MSE Annual Withholding Tax Exemption Certification for Military Spouse Instructions NOTE: This form must be renewed annually. Notice to Employers

State Tax Information. Servicemember or surviving spouse (if 60 on the last day of the tax year) 1989, all military retired pay is exempt from taxes.

Revenue Form K–4M 42A804–M (11–10) NONRESIDENT MILITARY SPOUSE Withholding Tax Exemption Certifi cate Commonwealth of Kentucky DEPARTMENT OF REVENUE

A Revenue Information Bulletin Military Spouse Income Tax Exemption a military spouse must file a Form L-4E each year if the spouse qualifies for the

(Exemption applies to Personal Property Tax Only) The Servicemembers’ Civil Relief Act exempts active duty military personnel from personal property tax in any

As a military spouse tax time can be stressful. Tax Tips for Military Spouses. Publication 3 may also be ordered by calling 1-800-TAX-FORM

Exemption from Withholding – Military Spouse Employee Ohio Employers: In November 2009, Congress passed the Federal Military Spouses Residency Relief Act, Public Law

Wisconsin Department of Revenue: Nonresident Military Spouse Withholding Exemption Common Questions

No Return Required-Military Online Form Property Tax Exemption for Certain Veterans If you are the spouse of a military servicemember,

TIR 09-23 Effect of the Military Spouses Residency Relief

Tax Information for Members of the U.S. Armed Forces

Idaho State Tax Commission Employee’s Idaho Military Spouse Withholding Exemption Certificate; On Idaho Form 43, select “Military Nonresident” for the

View, download and print fillable Ar-ms – Tax Exemption Certificate For Military Spouse in PDF format online. Browse 6 Military Tax Exempt Form Templates collected

Illinois Department of Revenue Constance Beard, may subtract tax-exempt military pay on Schedule Act that exempt wages from tax apply only to spouses of service

I am the spouse of a military service member, living in Virginia. Am I exempt from filing Virginia income tax returns under the Military Spouses Residency Relief Act

The State of Arkansas Tax Exemption Certificate For Military Spouse or Form AR-MS to claim exemption from Arkansas income tax .

Claiming Exemption from Maryland Withholding for Civilian Military Spouse: Maryland State employees who wish to claim exception for Maryland withholding on the basis

What is the Military Spouses Frequently Asked Questions Regarding the Military Spouses North Carolina withholding tax? The spouse must complete Form NC

Military and Spouse – State taxes Active duty service members have always been able to keep one state as their state of legal Military Spouses and State Taxes

The Military Spouses Residency Relief Act, Property Tax Exemption for Certain Veterans; Military Information (Form 558) Forms for Military Personnel.

The Military Spouses Residency To request a refund of exempt 2009 Louisiana income tax Worksheet and identified as military spouse income. Form W-2

Military Spouses Residency Relief in ink “Military Spouse” at the top of the Form and attach Act may claim an exemption from New Jersey Income Tax

New Mexico Taxation and Revenue Department Military Spouse Withholding Tax Exemption Statement Instructions Page 2 of 3 RPD-41348 Int. 07/2010 Form RPD-41348 must be

New Mexico Form RPD-41348 (Military Spouse Withholding Tax

TIR 09-23 Effect of the Military Spouses Residency Relief

Form OW-9MSE Annual Withholding Tax Exemption Certification for Military Spouse Instructions NOTE: This form must be renewed annually. Notice to Employers

The Best Tax Tips for Military Spouses in 2016. A military spouse is exempt from paying state income taxes when he or she: a.

Military Personnel & Their Spouses. The following instructions are for military personnel filing a Utah income tax return: Am I a Utah resident? Is my military income

No Return Required-Military Online Form Property Tax Exemption for Certain Veterans If you are the spouse of a military servicemember,

What Form Should I File Military Spouse VA. Free Help with your Taxes; Military Tax Tips; What Form Cigarette and Tobacco Taxes. Cigarette Resale Exemption

Spouse details – married or de facto 2017. You will usually find this amount on your spouse’s tax return or Make sure you include only your spouse’s exempt

Military Spouses and State Taxes TurboTax

Form Ar-ms Tax Exemption Certificate For Military Spouse

16/05/2018 · Forms and Instructions. Form See Tax Information for Members of the Military. Tax Laws Affecting the Military. These tax laws provide some special

Form OW-9MSE Annual Withholding Tax Exemption Certification for Military Spouse Instructions NOTE: This form must be renewed annually. Notice to Employers

Active Military . If Carolina tax on that income. Military Spouse met to qualify for exemption. If you are the spouse of a servicemember who is

Claiming Exemption from Maryland Withholding for Civilian Military Spouse: Maryland State employees who wish to claim exception for Maryland withholding on the basis

State Tax Information. Servicemember or surviving spouse (if 60 on the last day of the tax year) 1989, all military retired pay is exempt from taxes.

Form OW-9-MSE Oklahoma Tax Commission Calendar Year

WH-4MIL ANNUAL NONRESIDENT MILITARY SPOUSE Earned

COM/RAD 4 7- Employee information Military spouse information Exemption from Maryland Withholding Tax for a Qualified Civilian Spouse of a U.S. Armed

The Best Tax Tips for Military Spouses in 2016. A military spouse is exempt from paying state income taxes when he or she: a.

Military Personnel & Their Spouses. The following instructions are for military personnel filing a Utah income tax return: Am I a Utah resident? Is my military income

DEPARTMENT OF TAXATION PERSONAL EXEMPTION WORKSHEET FORM VA-4 EMPLOYEE’S VIRGINIA INCOME TAX WITHHOLDING EXEMPTION as amended by the Military Spouses

Revenue Form K–4M 42A804–M (11–10) NONRESIDENT MILITARY SPOUSE Withholding Tax Exemption Certifi cate Commonwealth of Kentucky DEPARTMENT OF REVENUE

Download or print the 2017 Colorado (Military Spouse — Exemption from Withholding) (2017) and other income tax forms from the Colorado Department of Revenue.

Kansas employers should request evidence that the military spouse is Spouses claiming an exemption from Kansas Withholding tax may Kansas Department of Revenue .

Withholding and Taxation of Certain Nonresident Military Spouses 1) may be exempt from Georgia income tax files a withholding exemption form in

Illinois Department of Revenue Constance Beard, may subtract tax-exempt military pay on Schedule Act that exempt wages from tax apply only to spouses of service

The Military Spouses Residency To request a refund of exempt 2009 Louisiana income tax Worksheet and identified as military spouse income. Form W-2

MILITARY SPOUSES RESIDENCY RELIEF ACT . eligible spouses should claim an exemption from servicemember is still subject to Mississippi income tax on non

I am the spouse of a military service member, living in Virginia. Am I exempt from filing Virginia income tax returns under the Military Spouses Residency Relief Act

Military Spouses Residency Relief Act Revised April 21

Annual Withholding Tax Exemption Certification for

Nonresident Military Service Members and Spouses. A recent federal law provides an exemption from state income tax for any servicemember’s spouse, who is present in a

IL-W-5-NR Employee’s Statement of Nonresidence in Illinois • is exempt from Illinois Income Tax on compensation under the Military Spouses Residency Relief Act.

Where to Get California Tax Forms and Publications Tax Returns on page 2 . Military Spouses Residency Relief Act Deployed Military Exemption – Minimum

… you do not have to file a Maryland income tax return. Military and military pay. You must also file Form spouses in the military and not

How does the federal Military Spouses Residency Relief Act Under the new Military Spouses Residency Relief Act, Tax Forms: Powered By Oracle

APPLICATION FOR TAX EXEMPTION or TAX RELIEF FOR MILITARY SERVICEMEMBERS & LEGAL SPOUSES (Exemption applies to Personal Property Tax Only)

What is the Military Spouses Frequently Asked Questions Regarding the Military Spouses North Carolina withholding tax? The spouse must complete Form NC

Form M-4-MS Annual Withholding Tax Exemption Certificate for Nonresident Military Spouse Read instructions below before completing this form. After completion, give

Download or print the 2017 New Mexico Form RPD-41348 (Military Spouse Withholding Tax Exemption Statement) for FREE from the New Mexico Taxation and Revenue Department.

If your spouse is in the military, you likely move from state to state. Generally speaking, the state that you live and work in during any given tax year is the state

Demystifying the MSRRA (Military Spouse While the income tax protections for military spouses are now Wisconsin / Form W-221. States with no income tax

The Best Tax Tips for Military Spouses in 2016. A military spouse is exempt from paying state income taxes when he or she: a.

Page 1 of 1 Military Spouses Residency Relief Act Claim For Property Tax Exemption In The State of Connecticut Amendment Under The Service Members’ Civil Relief Act

APPLICATION FOR TAX EXEMPTION or TAX RELIEF FOR MILITARY

MilSpouse State Tax Guide to Using MSRRA – IFM My Money Blog

I am the spouse of a military service member, living in Virginia. Am I exempt from filing Virginia income tax returns under the Military Spouses Residency Relief Act

Form WH-4MIL is to be used only for employees claiming exemption from Indiana’s income tax withholding requirements because they meet the conditions set forth under

Page 1 of 1 Military Spouses Residency Relief Act Claim For Property Tax Exemption In The State of Connecticut Amendment Under The Service Members’ Civil Relief Act

Military Personnel & Their Spouses. The following instructions are for military personnel filing a Utah income tax return: Am I a Utah resident? Is my military income

Withholding and Taxation of Certain Nonresident Military Spouses 1) may be exempt from Georgia income tax files a withholding exemption form in

Form OW-9-MSE Oklahoma Tax Commission Calendar Year

How does the federal Military Spouses Residency Relief Act

Revenue Form K–4M 42A804–M (11–10) NONRESIDENT MILITARY SPOUSE Withholding Tax Exemption Certifi cate Commonwealth of Kentucky DEPARTMENT OF REVENUE

IL-W-5-NR Employee’s Statement of Nonresidence in Illinois • is exempt from Illinois Income Tax on compensation under the Military Spouses Residency Relief Act.

Nonresident Military Spouse Withholding Exemption Legal last name Legal first name M.I. Social Security Number Address (number and street) City or Post Office State

Military Personnel & Their Spouses. The following instructions are for military personnel filing a Utah income tax return: Am I a Utah resident? Is my military income

New York State Income Tax Exemption for Military Pay. your spouse’s income) may be subject to tax. about NYS tax exemptions for Veterans and access forms,

Form WH-4MIL is to be used only for employees claiming exemption from Indiana’s income tax withholding requirements because they meet the conditions set forth under

Military Information dor.mo.gov

Military Reference Guide dor.mo.gov

SERVICE EXEMPTION FROM SPECIFIC OWNERSHIP TAX AFFIDAVIT required to be attached to this form. Servicemember’s spouse’s military ID must list the servicemember

Idaho State Tax Commission Employee’s Idaho Military Spouse Withholding Exemption Certificate; On Idaho Form 43, select “Military Nonresident” for the

(Exemption applies to Personal Property Tax Only) The Servicemembers’ Civil Relief Act exempts active duty military personnel from personal property tax in any

New Mexico Taxation and Revenue Department Military Spouse Withholding Tax Exemption Statement Instructions Page 2 of 3 RPD-41348 Int. 07/2010 Form RPD-41348 must be

Military Spouses Residency Relief A SM does not pay State taxes on military pay and like New Jersey and Pennsylvania, exempt from taxation the

Kansas employers should request evidence that the military spouse is Spouses claiming an exemption from Kansas Withholding tax may Kansas Department of Revenue .

… Tax Exemption Certificate for Military Spouse, Form a completed Military Spouse Withholding Tax Exemption to “MilSpouse State Tax Guide to

Indiana Department of Revenue Annual Nonresident Military Spouse Earned Income Withholding Tax Exemption Form This form is for the employer’s records.

No Return Required-Military Online Form Property Tax Exemption for Certain Veterans If you are the spouse of a military servicemember,

16/05/2018 · Forms and Instructions. Form See Tax Information for Members of the Military. Tax Laws Affecting the Military. These tax laws provide some special

Tax Exemption for Military Servicemembers & Legal Spouses

Revenue Information Bulletin Military Spouses Residency

SERVICE EXEMPTION FROM SPECIFIC OWNERSHIP TAX AFFIDAVIT required to be attached to this form. Servicemember’s spouse’s military ID must list the servicemember

Wisconsin Department of Revenue: Nonresident Military Spouse Withholding Exemption Common Questions

Oregon doesn’t tax your military pay while you are stationed in Oregon. File an Oregon Form OR-40-N if you or your spouse had income from other Oregon sources.

Nonresident Military Service Members and Spouses. A recent federal law provides an exemption from state income tax for any servicemember’s spouse, who is present in a

Arkansas tax exemption for military spouses. each non-resident member should fill out the tax exemption certificate and send the form through mail or email

Military Spouses Residency Relief in ink “Military Spouse” at the top of the Form and attach Act may claim an exemption from New Jersey Income Tax

Idaho State Tax Commission Employee’s Idaho Military Spouse Withholding Exemption Certificate; On Idaho Form 43, select “Military Nonresident” for the

Military Spouses Residency Relief A SM does not pay State taxes on military pay and like New Jersey and Pennsylvania, exempt from taxation the

If your spouse is in the military, you likely move from state to state. Generally speaking, the state that you live and work in during any given tax year is the state

What Form Should I File Military Spouse VA. Free Help with your Taxes; Military Tax Tips; What Form Cigarette and Tobacco Taxes. Cigarette Resale Exemption

Exemption from Withholding – Military Spouse Employee Ohio Employers: In November 2009, Congress passed the Federal Military Spouses Residency Relief Act, Public Law

MILITARY SPOUSES RESIDENCY RELIEF ACT . eligible spouses should claim an exemption from servicemember is still subject to Mississippi income tax on non

The Military Spouses Residency Relief Act, Property Tax Exemption for Certain Veterans; Military Information (Form 558) Forms for Military Personnel.

Military Spouses and State Taxes TurboTax

Military Idaho State Tax Commission

Illinois Department of Revenue Constance Beard, may subtract tax-exempt military pay on Schedule Act that exempt wages from tax apply only to spouses of service

Active Military . If Carolina tax on that income. Military Spouse met to qualify for exemption. If you are the spouse of a servicemember who is

(Exemption applies to Personal Property Tax Only) The Servicemembers’ Civil Relief Act exempts active duty military personnel from personal property tax in any

If your spouse is in the military, you likely move from state to state. Generally speaking, the state that you live and work in during any given tax year is the state

A Revenue Information Bulletin Military Spouse Income Tax Exemption a military spouse must file a Form L-4E each year if the spouse qualifies for the

Download or print the 2017 Colorado Form DR 1059 (Military Spouse — Exemption from Withholding) for FREE from the Colorado Department of Revenue.

Revenue Form K–4M 42A804–M (11–10) NONRESIDENT MILITARY SPOUSE Withholding Tax Exemption Certifi cate Commonwealth of Kentucky DEPARTMENT OF REVENUE

Nonresident Military Spouse Withholding Exemption Legal last name Legal first name M.I. Social Security Number Address (number and street) City or Post Office State

… exemption under the MSRRA must complete Form M-4-MS, Annual Withholding Tax Exemption Certificate for Tax Exemption Certificate for Military Spouse,

Military and Spouse – State taxes Active duty service members have always been able to keep one state as their state of legal Military Spouses and State Taxes

Withholding Tax Exemption Certificate A4-MSFORM Employers are required to obtain from the employee a clear photocopy of their current military spouse ID, Form DD

View, download and print fillable Ar-ms – Tax Exemption Certificate For Military Spouse in PDF format online. Browse 6 Military Tax Exempt Form Templates collected

2/03/2014 · MilSpouse State Tax Guide to Using MSRRA. The Earned Income Withholding Tax Exemption Form, Military Spouse Withholding Tax Exemption

Kansas employers should request evidence that the military spouse is Spouses claiming an exemption from Kansas Withholding tax may Kansas Department of Revenue .

Form OW-9-MSE Oklahoma Tax Commission Calendar Year

MARYLAND Exemption from Maryland Withholding Tax FORM

State of Louisiana Exemption from Withholding Louisiana Income Tax Form L-4E as amended by the Military Spouses Residency Relief Act

Withholding Tax Exemption Certificate A4-MSFORM Employers are required to obtain from the employee a clear photocopy of their current military spouse ID, Form DD

Oregon doesn’t tax your military pay while you are stationed in Oregon. File an Oregon Form OR-40-N if you or your spouse had income from other Oregon sources.

What is the Military Spouses Frequently Asked Questions Regarding the Military Spouses North Carolina withholding tax? The spouse must complete Form NC

… Tax Exemption Certificate for Military Spouse, Form a completed Military Spouse Withholding Tax Exemption to “MilSpouse State Tax Guide to

Civilian Spouse Employed in Maryland: The wages earned by a spouse of a nonresident U.S. servicemember may be exempt from Maryland income tax under the Military

I claim exemption from Maryland local tax because I live as amended by the Military Spouses Employee’s Maryland Withholding Exemption Certificate FORM

Claiming Exemption from Maryland Withholding for Civilian Military Spouse: Maryland State employees who wish to claim exception for Maryland withholding on the basis

COM/RAD 4 7- Employee information Military spouse information Exemption from Maryland Withholding Tax for a Qualified Civilian Spouse of a U.S. Armed

16/05/2018 · Forms and Instructions. Form See Tax Information for Members of the Military. Tax Laws Affecting the Military. These tax laws provide some special

Download or print the 2017 Colorado (Military Spouse — Exemption from Withholding) (2017) and other income tax forms from the Colorado Department of Revenue.

As a military spouse tax time can be stressful. Tax Tips for Military Spouses. Publication 3 may also be ordered by calling 1-800-TAX-FORM

Home Forms.OK.Gov Page 1 Annual Withholding Tax Exemption Certification for Military Spouse. Page 1 Previous: 1 of 2: Next :

How to Fill Out a W-4 Form When Your Spouse Is in the

Kansas Department of Revenue

DEPARTMENT OF TAXATION PERSONAL EXEMPTION WORKSHEET FORM VA-4 EMPLOYEE’S VIRGINIA INCOME TAX WITHHOLDING EXEMPTION as amended by the Military Spouses

Idaho State Tax Commission Employee’s Idaho Military Spouse Withholding Exemption Certificate; On Idaho Form 43, select “Military Nonresident” for the

Download or print the 2017 Colorado Form DR 1059 (Military Spouse — Exemption from Withholding) for FREE from the Colorado Department of Revenue.

Form M-4-MS Annual Withholding Tax Exemption Certificate for Nonresident Military Spouse Read instructions below before completing this form. After completion, give

The Military Spouses Residency Relief Act amends the The effective date for the income tax exemption is for the tax Servicemember’s Form W-2; Spouse’s

Certificate of Exemption from Yes No Are you a military spouse exempt under the • Information and forms are available on the Tax Department’s