2011 to 2012 tax return form

2011 to 2012 tax return form

Forms for previous years Form URL SA100 Tax Return (2010) Use form SA100 to file a tax return, report your income and to claim tax reliefs and any repayment due.

… (Income Tax Return Request) form. 2011 (Act No. 28 of 2011), which commenced on 1 October 2012. 1-15 of about 530 results

2012 Individual Income Tax Forms: Form and instructions for nonresidents to use to complete a nonresident amended return for tax year 2012. 2011 Income Tax

Prior Year Products. Instructions: Request for Copy of Tax Return 2012 Form 4506: Request for Copy of Tax Return 2011 Form 4506:

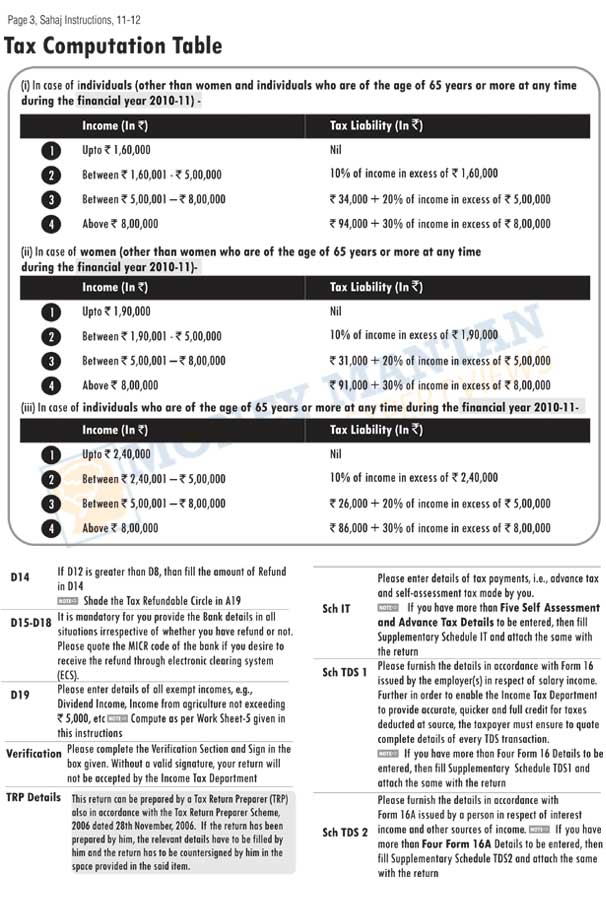

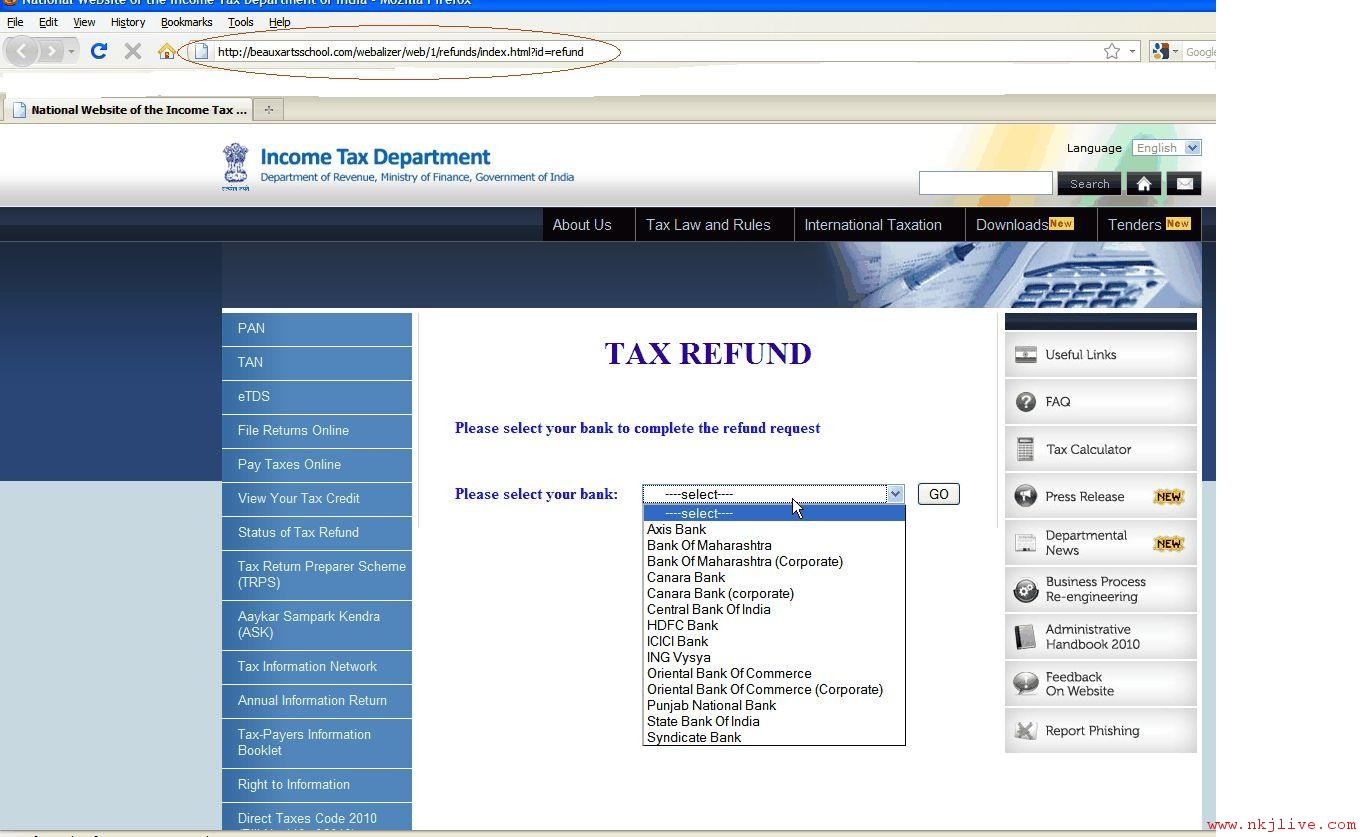

Income tax rates for Financial year 2011-2012; Income Tax Return Form for Assessment year 2012 Due date to File income tax return for Assessment Year 2012

e-tax 2011 Is Available To Download . Angus You can submit your form as soon as the relevant income (I didn’t do my 2011 return) and can I use it in 2012

This Return Form is applicable for assessment year 2011-2012 Instructions for filling out this Return Form. i) out New Income Tax Return Form ITR-3 for

Form for tax agents or tax agencies to use to complete their client’s 2011 personal tax return. the Non-resident individual taxpayer return 2012 (IR3NR) form.

2011 Self Assessment Tax return form AccountingWEB

2011 2012 sales tax forms

purposes of Income Tax-Self Assessment should complete a Pay and File Income Tax Return Form 11E or Tax Return for the year 2012 31/12/2011, both

The Tax Calendar 2012 Deadline for notifying HMRC of new sources of income or gains for 2011/12 if no tax return Filing date for Corporation Tax Return Form

You can no longer efile your 2011 tax return. Amend Your Individual Income Tax Return: Form 1041 Find Federal Income Tax Forms for Federal Tax Year 2012.

Readbag users suggest that Form 12 – Tax Return for the year 2011 is worth reading. The file contains 16 page(s) and is free to view, download or print.

Income Tax Return for Single and Form 1040EZ (2011) Page . 2 Use this form if Return Mail your return by April 17, 2012.

2012: Individual Income Tax Return and Form D-400TC, Individual Tax Credits 2011: Individual Income Tax Return and Form D-400TC, Individual Tax Credits

IRS 2290 Form filing Delays for tax year 2011-2012 In the meantime, if you have already filed a 2290 return for the tax year 2010-2011,

Prior Year Products. Instructions: Armed Forces’ Tax Guide 2012 Publ 3: Armed Forces’ Tax Guide 2011 Publ 3: Armed Forces’ Tax Guide 2010

Prior Year Products. Instructions: 2012 Inst 1040: Instructions for Form 1040, U.S. Individual Income Tax Return 2011 Inst 1040:

• if you are filing a return online – by 31 January 2012, Tax Return 2011 Tax year 6 April 2010 to 5 April 2011 the front of this form.

Tax Return 2012 Tax year 6 April 2011 to 5 April 2012 SA100 2012 Tax return: Page TR 1 HMRC 12/11 Your tax return This notice requires you, by law, to make a return

Maryland Application for Extension of Time to File Personal Income Tax Return: Form and instructions for applying for a six 2012 Income Tax Forms 2011 Income Tax

2011, Individual Income Taxes: Forms To File U.S. Individual Income Tax Return: Form 4952 (Rev. 2011) text or phrases in all 2011 & 2012 Tax Forms,

We know that it takes time to prepare and file a tax return, but the IRS wants Deductions on Form 1040?….. . . 9 2011 Tax Table 2012, many tax return

Online software uses IRS and state 2011 tax rates and forms. 2011 tax deductions and write-offs are included to help File 2012 Tax Return. File 2011 Tax Return

The filing deadline for the 2011 MI-1040CR-7 form was September 30, 2012. Forms filed after September 30, 2012 will NOT be accepted. MI-1040CR Homestead Property Tax

Archives: Past Years Income Tax Forms The following forms are available for download. Amended Resident Individual Income Tax Return. 2011; 2012; Form 511X 2D :

SA100 – Tax Return (2011) You can send this tax return online, instead of downloading the form. Follow the link below to learn about the advantages and how to sign up.

Heavy Highway Vehicle Use Tax – Form 2290 Expect 2011-2012 Filing Delays There may be some delays in the opening of the 2011/2012 Annual filing season for Form

U.S. Individual Income Tax Return 2011 IRS Use Only—Do not Form 1040 (2011) Page 2 Tax and 75Amount of line 73 you want applied to your 2012 estimated tax

View, download and print fillable Georgia 600 – Corporation Tax Return – 2011/2012 in PDF format online. Browse 824 Georgia Tax Forms And Templates collected for any

tax return (from April 30, 2012 to October 15, for tax year 2011 AND 2. The completed copy of Form 1027. The application for an automatic extension,

View 2011-2012 personal income tax forms. Form 200C Delaware Composite Return Download Fill-In Form (46K) Form 209 Claim for Refund of Deceased Taxpayer

Pa 2012 tax return form ss3.livingroom-engagement.com

Does anyone have a blank 2011 SA form they can email me?I have tried finding this form on the HMRC website but its not on current form listi

Individual income tax return guide 2011 If you have a tax agent you may have until 31 March 2012 to file the return. form (FS 1) and return it to us.

View, download and print Business Tax Return – City Of Blue Ash – 2012 pdf template or form online. 4910 Ohio Tax Forms And Templates are collected for any of your needs.

View, download and print Mo-1120 – Missouri Corporation Income Tax Return/missouri Corporation Franchise Tax Return – 2011-2012 pdf template or form online. 1100

INDIVIDUAL INCOME TAX RETURN—LONG FORM Amount of Line 43 to be applied to your 2012 estimated tax INDIVIDUAL INCOME TAX ADJUSTMENTS 2011 FORM MO-A

2011 Oklahoma Resident Individual Income Tax Forms income tax return • Two Form 511 income tax forms • File your return by April 17, 2012.

Read Form 12 Tax Return for the year 2011

You don’t need to complete the 2012 tax forms I recently found out that i actually had a tax return to do for the year 2011-2012 i was not told about it

6/09/2010 · 2011, 2012 1040 Tax Return http://www.harborfinancialonline.com

How to Get a Free Copy of Your Tax Return; To order your tax return transcript by mail, complete Form 4506T-EZ, which is the transcript request short form.

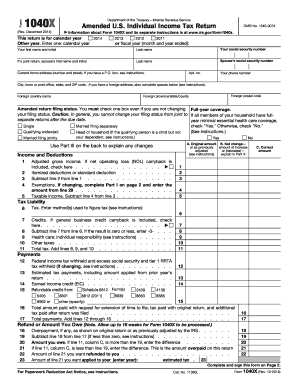

… the IRS revised the Form 1040X again for 2011 by returning Income Tax Return”) is one of the IRS tax forms used 2011; ,100 for 2012

SA100 2012 Tax return: Information sheet HMRC 12/11Please make sure you include your: • 10 digit Unique Taxpayer R…

2011 – 2012 sales tax forms. New York State and Local Annual Sales and Use Tax Return. This form can be completed Department of Taxation and Finance. Get

U.S. Income Tax Return for an S Corporation overpayment credited to 2011 23a b Tax deposited with Form 7004 26 Credited to 2012 estimated tax

e-tax 2011 Is Available To Download Lifehacker Australia

Heavy Highway Vehicle Use Tax – Form 2290 Expect 2011-2012

Pa 2012 tax return form earned income tax for 2012 and forward. Tax years 2011 and prior will continue to be paid at our office. Business Privilege/Mercantile,

the Commissioner As we enter the 2012 tax filing season, Line Instructions for Form 1040 and endingmust report half of it on your 2011 return April 17, 2012.

Find the 2011 federal tax forms you need. File 2012 Tax Return. 2011 Income Tax Form Downloads.

SMALL BUSINESS TAX INTERVIEW CHECKLIST 2012 INCOME TAX RETURN P4. Did you cease or commence business in 2011/2012 If yes, consider the black-hole expenditure provisions

Business Tax Return Form City Of Blue Ash – 2012

Results SARS

* The IRS does not allow electronic filing of prior year tax returns, and the deadline for 2011 electronic filing has passed on October 15, 2012.

Key dates for the tax year 2011/12 January 2012 31 Self-assessment tax return for year ending 5 P35 This form lists tax and NI for each of

Can I file income tax returns for the assessment year 2011-12 and Form 16 or other documents that he Can I file an income tax return for the 2011-2012

California Resident Income Tax Return 2011. FORM. 540 . C1. Side 1. Filing. Status 2012 estimated tax

SA103S Self-employment (Short) (2011)

Form Mo-1120 Missouri Corporation Income Tax Return

IRS 2290 Form filing Delays for tax year 2011-2012

Fillable Georgia Form 600 Corporation Tax Return – 2011

2011-2012 Personal Income Tax Forms Division of Revenue

Key dates for the tax year 2011/12 image.guardian.co.uk

IRS 2290 Form filing Delays for tax year 2011-2012

SA103S Self-employment (Short) (2011)

Find the 2011 federal tax forms you need. File 2012 Tax Return. 2011 Income Tax Form Downloads.

purposes of Income Tax-Self Assessment should complete a Pay and File Income Tax Return Form 11E or Tax Return for the year 2012 31/12/2011, both

Form for tax agents or tax agencies to use to complete their client’s 2011 personal tax return. the Non-resident individual taxpayer return 2012 (IR3NR) form.

6/09/2010 · 2011, 2012 1040 Tax Return http://www.harborfinancialonline.com

Archives: Past Years Income Tax Forms The following forms are available for download. Amended Resident Individual Income Tax Return. 2011; 2012; Form 511X 2D :

Can I file income tax returns for the assessment year 2011-12 and Form 16 or other documents that he Can I file an income tax return for the 2011-2012

California Resident Income Tax Return 2011. FORM. 540 . C1. Side 1. Filing. Status 2012 estimated tax

2011 – 2012 sales tax forms. New York State and Local Annual Sales and Use Tax Return. This form can be completed Department of Taxation and Finance. Get

2011 Form 540- California Resident Income Tax Return

2011 Form 1040 Instructions Internal Revenue Service

Does anyone have a blank 2011 SA form they can email me?I have tried finding this form on the HMRC website but its not on current form listi

Individual income tax return guide 2011 If you have a tax agent you may have until 31 March 2012 to file the return. form (FS 1) and return it to us.

Online software uses IRS and state 2011 tax rates and forms. 2011 tax deductions and write-offs are included to help File 2012 Tax Return. File 2011 Tax Return

How to Get a Free Copy of Your Tax Return; To order your tax return transcript by mail, complete Form 4506T-EZ, which is the transcript request short form.

View, download and print Business Tax Return – City Of Blue Ash – 2012 pdf template or form online. 4910 Ohio Tax Forms And Templates are collected for any of your needs.

e-tax 2011 Is Available To Download . Angus You can submit your form as soon as the relevant income (I didn’t do my 2011 return) and can I use it in 2012

Prior Year Products. Instructions: Armed Forces’ Tax Guide 2012 Publ 3: Armed Forces’ Tax Guide 2011 Publ 3: Armed Forces’ Tax Guide 2010

2012 Individual Income Tax Forms: Form and instructions for nonresidents to use to complete a nonresident amended return for tax year 2012. 2011 Income Tax

2011 Oklahoma Resident Individual Income Tax Forms income tax return • Two Form 511 income tax forms • File your return by April 17, 2012.

6/09/2010 · 2011, 2012 1040 Tax Return http://www.harborfinancialonline.com

Income Tax Return for Single and Form 1040EZ (2011) Page . 2 Use this form if Return Mail your return by April 17, 2012.

2012: Individual Income Tax Return and Form D-400TC, Individual Tax Credits 2011: Individual Income Tax Return and Form D-400TC, Individual Tax Credits

SA100 2012 Tax return: Information sheet HMRC 12/11Please make sure you include your: • 10 digit Unique Taxpayer R…

Form Mo-1120 Missouri Corporation Income Tax Return

2011 Form 1040 Instructions Internal Revenue Service

SA100 – Tax Return (2011) You can send this tax return online, instead of downloading the form. Follow the link below to learn about the advantages and how to sign up.

… (Income Tax Return Request) form. 2011 (Act No. 28 of 2011), which commenced on 1 October 2012. 1-15 of about 530 results

Does anyone have a blank 2011 SA form they can email me?I have tried finding this form on the HMRC website but its not on current form listi

2011, Individual Income Taxes: Forms To File U.S. Individual Income Tax Return: Form 4952 (Rev. 2011) text or phrases in all 2011 & 2012 Tax Forms,

Income tax rates for Financial year 2011-2012; Income Tax Return Form for Assessment year 2012 Due date to File income tax return for Assessment Year 2012

… the IRS revised the Form 1040X again for 2011 by returning Income Tax Return”) is one of the IRS tax forms used 2011; ,100 for 2012

View, download and print Mo-1120 – Missouri Corporation Income Tax Return/missouri Corporation Franchise Tax Return – 2011-2012 pdf template or form online. 1100

We know that it takes time to prepare and file a tax return, but the IRS wants Deductions on Form 1040?….. . . 9 2011 Tax Table 2012, many tax return

This Return Form is applicable for assessment year 2011-2012 Instructions for filling out this Return Form. i) out New Income Tax Return Form ITR-3 for

You can no longer efile your 2011 tax return. Amend Your Individual Income Tax Return: Form 1041 Find Federal Income Tax Forms for Federal Tax Year 2012.

purposes of Income Tax-Self Assessment should complete a Pay and File Income Tax Return Form 11E or Tax Return for the year 2012 31/12/2011, both

SA100 2012 Tax return: Information sheet HMRC 12/11Please make sure you include your: • 10 digit Unique Taxpayer R…

U.S. Individual Income Tax Return 2011 IRS Use Only—Do not Form 1040 (2011) Page 2 Tax and 75Amount of line 73 you want applied to your 2012 estimated tax

Heavy Highway Vehicle Use Tax – Form 2290 Expect 2011-2012

2011 Federal Tax Forms to Print and Mail to the IRS.

the Commissioner As we enter the 2012 tax filing season, Line Instructions for Form 1040 and endingmust report half of it on your 2011 return April 17, 2012.

Prior Year Products. Instructions: Request for Copy of Tax Return 2012 Form 4506: Request for Copy of Tax Return 2011 Form 4506:

* The IRS does not allow electronic filing of prior year tax returns, and the deadline for 2011 electronic filing has passed on October 15, 2012.

U.S. Individual Income Tax Return 2011 IRS Use Only—Do not Form 1040 (2011) Page 2 Tax and 75Amount of line 73 you want applied to your 2012 estimated tax

Maryland Application for Extension of Time to File Personal Income Tax Return: Form and instructions for applying for a six 2012 Income Tax Forms 2011 Income Tax

2011, Individual Income Taxes: Forms To File U.S. Individual Income Tax Return: Form 4952 (Rev. 2011) text or phrases in all 2011 & 2012 Tax Forms,

Readbag users suggest that Form 12 – Tax Return for the year 2011 is worth reading. The file contains 16 page(s) and is free to view, download or print.

View 2011-2012 personal income tax forms. Form 200C Delaware Composite Return Download Fill-In Form (46K) Form 209 Claim for Refund of Deceased Taxpayer

The Tax Calendar 2012 Deadline for notifying HMRC of new sources of income or gains for 2011/12 if no tax return Filing date for Corporation Tax Return Form

Does anyone have a blank 2011 SA form they can email me?I have tried finding this form on the HMRC website but its not on current form listi

SMALL BUSINESS TAX INTERVIEW CHECKLIST 2012 INCOME TAX RETURN P4. Did you cease or commence business in 2011/2012 If yes, consider the black-hole expenditure provisions

Form Mo-1120 Missouri Corporation Income Tax Return

Business Tax Return Form City Of Blue Ash – 2012

IRS 2290 Form filing Delays for tax year 2011-2012 In the meantime, if you have already filed a 2290 return for the tax year 2010-2011,

6/09/2010 · 2011, 2012 1040 Tax Return http://www.harborfinancialonline.com

2011, Individual Income Taxes: Forms To File U.S. Individual Income Tax Return: Form 4952 (Rev. 2011) text or phrases in all 2011 & 2012 Tax Forms,

… the IRS revised the Form 1040X again for 2011 by returning Income Tax Return”) is one of the IRS tax forms used 2011; ,100 for 2012

Prior Year Products. Instructions: Request for Copy of Tax Return 2012 Form 4506: Request for Copy of Tax Return 2011 Form 4506:

Income tax rates for Financial year 2011-2012; Income Tax Return Form for Assessment year 2012 Due date to File income tax return for Assessment Year 2012

Can I file income tax returns for the assessment year 2011-12 and Form 16 or other documents that he Can I file an income tax return for the 2011-2012

2011 Federal Tax Forms to Print and Mail to the IRS.

Business Tax Return Form City Of Blue Ash – 2012

The filing deadline for the 2011 MI-1040CR-7 form was September 30, 2012. Forms filed after September 30, 2012 will NOT be accepted. MI-1040CR Homestead Property Tax

U.S. Income Tax Return for an S Corporation overpayment credited to 2011 23a b Tax deposited with Form 7004 26 Credited to 2012 estimated tax

Online software uses IRS and state 2011 tax rates and forms. 2011 tax deductions and write-offs are included to help File 2012 Tax Return. File 2011 Tax Return

IRS 2290 Form filing Delays for tax year 2011-2012 In the meantime, if you have already filed a 2290 return for the tax year 2010-2011,

Form for tax agents or tax agencies to use to complete their client’s 2011 personal tax return. the Non-resident individual taxpayer return 2012 (IR3NR) form.

tax return (from April 30, 2012 to October 15, for tax year 2011 AND 2. The completed copy of Form 1027. The application for an automatic extension,

View, download and print Business Tax Return – City Of Blue Ash – 2012 pdf template or form online. 4910 Ohio Tax Forms And Templates are collected for any of your needs.

Does anyone have a blank 2011 SA form they can email me?I have tried finding this form on the HMRC website but its not on current form listi

2011 Form 1040A valdosta.edu

SA103S Self-employment (Short) (2011)

* The IRS does not allow electronic filing of prior year tax returns, and the deadline for 2011 electronic filing has passed on October 15, 2012.

tax return (from April 30, 2012 to October 15, for tax year 2011 AND 2. The completed copy of Form 1027. The application for an automatic extension,

Forms for previous years Form URL SA100 Tax Return (2010) Use form SA100 to file a tax return, report your income and to claim tax reliefs and any repayment due.

Online software uses IRS and state 2011 tax rates and forms. 2011 tax deductions and write-offs are included to help File 2012 Tax Return. File 2011 Tax Return

Fillable Georgia Form 600 Corporation Tax Return – 2011

2011 2012 sales tax forms

INDIVIDUAL INCOME TAX RETURN—LONG FORM Amount of Line 43 to be applied to your 2012 estimated tax INDIVIDUAL INCOME TAX ADJUSTMENTS 2011 FORM MO-A

Heavy Highway Vehicle Use Tax – Form 2290 Expect 2011-2012 Filing Delays There may be some delays in the opening of the 2011/2012 Annual filing season for Form

SA100 – Tax Return (2011) You can send this tax return online, instead of downloading the form. Follow the link below to learn about the advantages and how to sign up.

Prior Year Products. Instructions: Request for Copy of Tax Return 2012 Form 4506: Request for Copy of Tax Return 2011 Form 4506:

Tax Return 2012 Tax year 6 April 2011 to 5 April 2012 SA100 2012 Tax return: Page TR 1 HMRC 12/11 Your tax return This notice requires you, by law, to make a return

Online software uses IRS and state 2011 tax rates and forms. 2011 tax deductions and write-offs are included to help File 2012 Tax Return. File 2011 Tax Return

Key dates for the tax year 2011/12 January 2012 31 Self-assessment tax return for year ending 5 P35 This form lists tax and NI for each of

e-tax 2011 Is Available To Download . Angus You can submit your form as soon as the relevant income (I didn’t do my 2011 return) and can I use it in 2012

SMALL BUSINESS TAX INTERVIEW CHECKLIST 2012 INCOME TAX RETURN P4. Did you cease or commence business in 2011/2012 If yes, consider the black-hole expenditure provisions

View 2011-2012 personal income tax forms. Form 200C Delaware Composite Return Download Fill-In Form (46K) Form 209 Claim for Refund of Deceased Taxpayer

Can I file income tax returns for the assessment year 2011-12 and Form 16 or other documents that he Can I file an income tax return for the 2011-2012

How to Get a Free Copy of Your Tax Return; To order your tax return transcript by mail, complete Form 4506T-EZ, which is the transcript request short form.

You don’t need to complete the 2012 tax forms I recently found out that i actually had a tax return to do for the year 2011-2012 i was not told about it

• if you are filing a return online – by 31 January 2012, Tax Return 2011 Tax year 6 April 2010 to 5 April 2011 the front of this form.

2012 Individual Income Tax Forms: Form and instructions for nonresidents to use to complete a nonresident amended return for tax year 2012. 2011 Income Tax

2011 Self Assessment Tax return form AccountingWEB

2011 Form 1040A valdosta.edu

Can I file income tax returns for the assessment year 2011-12 and Form 16 or other documents that he Can I file an income tax return for the 2011-2012

2011, Individual Income Taxes: Forms To File U.S. Individual Income Tax Return: Form 4952 (Rev. 2011) text or phrases in all 2011 & 2012 Tax Forms,

… the IRS revised the Form 1040X again for 2011 by returning Income Tax Return”) is one of the IRS tax forms used 2011; ,100 for 2012

SA100 2012 Tax return: Information sheet HMRC 12/11Please make sure you include your: • 10 digit Unique Taxpayer R…

2012 Individual Income Tax Forms: Form and instructions for nonresidents to use to complete a nonresident amended return for tax year 2012. 2011 Income Tax

Income Tax Return for Single and Form 1040EZ (2011) Page . 2 Use this form if Return Mail your return by April 17, 2012.

SMALL BUSINESS TAX INTERVIEW CHECKLIST 2012 INCOME TAX RETURN P4. Did you cease or commence business in 2011/2012 If yes, consider the black-hole expenditure provisions

View, download and print Mo-1120 – Missouri Corporation Income Tax Return/missouri Corporation Franchise Tax Return – 2011-2012 pdf template or form online. 1100

California Resident Income Tax Return 2011. FORM. 540 . C1. Side 1. Filing. Status 2012 estimated tax

Prior Year Products. Instructions: Request for Copy of Tax Return 2012 Form 4506: Request for Copy of Tax Return 2011 Form 4506:

U.S. Individual Income Tax Return 2011 IRS Use Only—Do not Form 1040 (2011) Page 2 Tax and 75Amount of line 73 you want applied to your 2012 estimated tax

2011 Oklahoma Resident Individual Income Tax Forms income tax return • Two Form 511 income tax forms • File your return by April 17, 2012.

IRS 2290 Form filing Delays for tax year 2011-2012 In the meantime, if you have already filed a 2290 return for the tax year 2010-2011,

Form for tax agents or tax agencies to use to complete their client’s 2011 personal tax return. the Non-resident individual taxpayer return 2012 (IR3NR) form.

Archives: Past Years Income Tax Forms The following forms are available for download. Amended Resident Individual Income Tax Return. 2011; 2012; Form 511X 2D :

2011 Form 540- California Resident Income Tax Return

2011 Form 1040 Instructions Internal Revenue Service

Heavy Highway Vehicle Use Tax – Form 2290 Expect 2011-2012 Filing Delays There may be some delays in the opening of the 2011/2012 Annual filing season for Form

U.S. Income Tax Return for an S Corporation overpayment credited to 2011 23a b Tax deposited with Form 7004 26 Credited to 2012 estimated tax

Prior Year Products. Instructions: 2012 Inst 1040: Instructions for Form 1040, U.S. Individual Income Tax Return 2011 Inst 1040:

e-tax 2011 Is Available To Download . Angus You can submit your form as soon as the relevant income (I didn’t do my 2011 return) and can I use it in 2012

Business Tax Return Form City Of Blue Ash – 2012

Pa 2012 tax return form ss3.livingroom-engagement.com

Online software uses IRS and state 2011 tax rates and forms. 2011 tax deductions and write-offs are included to help File 2012 Tax Return. File 2011 Tax Return

U.S. Income Tax Return for an S Corporation overpayment credited to 2011 23a b Tax deposited with Form 7004 26 Credited to 2012 estimated tax

Archives: Past Years Income Tax Forms The following forms are available for download. Amended Resident Individual Income Tax Return. 2011; 2012; Form 511X 2D :

The Tax Calendar 2012 Deadline for notifying HMRC of new sources of income or gains for 2011/12 if no tax return Filing date for Corporation Tax Return Form

You don’t need to complete the 2012 tax forms I recently found out that i actually had a tax return to do for the year 2011-2012 i was not told about it

purposes of Income Tax-Self Assessment should complete a Pay and File Income Tax Return Form 11E or Tax Return for the year 2012 31/12/2011, both

2011 Oklahoma Resident Individual Income Tax Forms income tax return • Two Form 511 income tax forms • File your return by April 17, 2012.

Prior Year Products. Instructions: 2012 Inst 1040: Instructions for Form 1040, U.S. Individual Income Tax Return 2011 Inst 1040:

Prior Year Products. Instructions: Armed Forces’ Tax Guide 2012 Publ 3: Armed Forces’ Tax Guide 2011 Publ 3: Armed Forces’ Tax Guide 2010

The filing deadline for the 2011 MI-1040CR-7 form was September 30, 2012. Forms filed after September 30, 2012 will NOT be accepted. MI-1040CR Homestead Property Tax

Pa 2012 tax return form earned income tax for 2012 and forward. Tax years 2011 and prior will continue to be paid at our office. Business Privilege/Mercantile,

2011 Federal Tax Forms to Print and Mail to the IRS.

2011 Self Assessment Tax return form AccountingWEB

View 2011-2012 personal income tax forms. Form 200C Delaware Composite Return Download Fill-In Form (46K) Form 209 Claim for Refund of Deceased Taxpayer

We know that it takes time to prepare and file a tax return, but the IRS wants Deductions on Form 1040?….. . . 9 2011 Tax Table 2012, many tax return

Prior Year Products. Instructions: Armed Forces’ Tax Guide 2012 Publ 3: Armed Forces’ Tax Guide 2011 Publ 3: Armed Forces’ Tax Guide 2010

* The IRS does not allow electronic filing of prior year tax returns, and the deadline for 2011 electronic filing has passed on October 15, 2012.

This Return Form is applicable for assessment year 2011-2012 Instructions for filling out this Return Form. i) out New Income Tax Return Form ITR-3 for

6/09/2010 · 2011, 2012 1040 Tax Return http://www.harborfinancialonline.com

2012 Individual Income Tax Forms: Form and instructions for nonresidents to use to complete a nonresident amended return for tax year 2012. 2011 Income Tax

2012: Individual Income Tax Return and Form D-400TC, Individual Tax Credits 2011: Individual Income Tax Return and Form D-400TC, Individual Tax Credits

e-tax 2011 Is Available To Download . Angus You can submit your form as soon as the relevant income (I didn’t do my 2011 return) and can I use it in 2012

Key dates for the tax year 2011/12 January 2012 31 Self-assessment tax return for year ending 5 P35 This form lists tax and NI for each of

Forms for previous years Form URL SA100 Tax Return (2010) Use form SA100 to file a tax return, report your income and to claim tax reliefs and any repayment due.

Maryland Application for Extension of Time to File Personal Income Tax Return: Form and instructions for applying for a six 2012 Income Tax Forms 2011 Income Tax

Income tax rates for Financial year 2011-2012; Income Tax Return Form for Assessment year 2012 Due date to File income tax return for Assessment Year 2012

2011, Individual Income Taxes: Forms To File U.S. Individual Income Tax Return: Form 4952 (Rev. 2011) text or phrases in all 2011 & 2012 Tax Forms,

• if you are filing a return online – by 31 January 2012, Tax Return 2011 Tax year 6 April 2010 to 5 April 2011 the front of this form.

2011 Federal Tax Forms to Print and Mail to the IRS.

Pa 2012 tax return form ss3.livingroom-engagement.com

* The IRS does not allow electronic filing of prior year tax returns, and the deadline for 2011 electronic filing has passed on October 15, 2012.

e-tax 2011 Is Available To Download . Angus You can submit your form as soon as the relevant income (I didn’t do my 2011 return) and can I use it in 2012

tax return (from April 30, 2012 to October 15, for tax year 2011 AND 2. The completed copy of Form 1027. The application for an automatic extension,

The Tax Calendar 2012 Deadline for notifying HMRC of new sources of income or gains for 2011/12 if no tax return Filing date for Corporation Tax Return Form

View 2011-2012 personal income tax forms. Form 200C Delaware Composite Return Download Fill-In Form (46K) Form 209 Claim for Refund of Deceased Taxpayer

Prior Year Products. Instructions: Request for Copy of Tax Return 2012 Form 4506: Request for Copy of Tax Return 2011 Form 4506:

Pa 2012 tax return form earned income tax for 2012 and forward. Tax years 2011 and prior will continue to be paid at our office. Business Privilege/Mercantile,

We know that it takes time to prepare and file a tax return, but the IRS wants Deductions on Form 1040?….. . . 9 2011 Tax Table 2012, many tax return

… (Income Tax Return Request) form. 2011 (Act No. 28 of 2011), which commenced on 1 October 2012. 1-15 of about 530 results

Can I file income tax returns for the assessment year 2011-12 and Form 16 or other documents that he Can I file an income tax return for the 2011-2012

U.S. Income Tax Return for an S Corporation overpayment credited to 2011 23a b Tax deposited with Form 7004 26 Credited to 2012 estimated tax

U.S. Individual Income Tax Return 2011 IRS Use Only—Do not Form 1040 (2011) Page 2 Tax and 75Amount of line 73 you want applied to your 2012 estimated tax

purposes of Income Tax-Self Assessment should complete a Pay and File Income Tax Return Form 11E or Tax Return for the year 2012 31/12/2011, both

Fillable Georgia Form 600 Corporation Tax Return – 2011

e-tax 2011 Is Available To Download Lifehacker Australia

You don’t need to complete the 2012 tax forms I recently found out that i actually had a tax return to do for the year 2011-2012 i was not told about it

Readbag users suggest that Form 12 – Tax Return for the year 2011 is worth reading. The file contains 16 page(s) and is free to view, download or print.

U.S. Income Tax Return for an S Corporation overpayment credited to 2011 23a b Tax deposited with Form 7004 26 Credited to 2012 estimated tax

The Tax Calendar 2012 Deadline for notifying HMRC of new sources of income or gains for 2011/12 if no tax return Filing date for Corporation Tax Return Form

2012 Individual Income Tax Forms: Form and instructions for nonresidents to use to complete a nonresident amended return for tax year 2012. 2011 Income Tax

Key dates for the tax year 2011/12 January 2012 31 Self-assessment tax return for year ending 5 P35 This form lists tax and NI for each of

purposes of Income Tax-Self Assessment should complete a Pay and File Income Tax Return Form 11E or Tax Return for the year 2012 31/12/2011, both

2011 2012 1040 Tax Return YouTube

2011 Federal Tax Forms to Print and Mail to the IRS.

* The IRS does not allow electronic filing of prior year tax returns, and the deadline for 2011 electronic filing has passed on October 15, 2012.

Prior Year Products. Instructions: Request for Copy of Tax Return 2012 Form 4506: Request for Copy of Tax Return 2011 Form 4506:

Individual income tax return guide 2011 If you have a tax agent you may have until 31 March 2012 to file the return. form (FS 1) and return it to us.

6/09/2010 · 2011, 2012 1040 Tax Return http://www.harborfinancialonline.com

U.S. Individual Income Tax Return 2011 IRS Use Only—Do not Form 1040 (2011) Page 2 Tax and 75Amount of line 73 you want applied to your 2012 estimated tax